[ad_1]

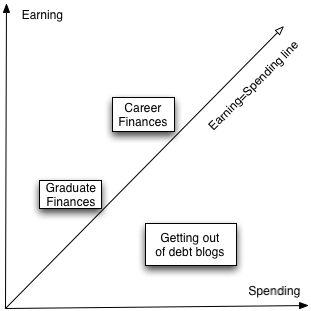

Private finance blogs primarily fall in three main classes. First, there are the “getting out of debt” blogs. Second, there are the “simply acquired out of school” private finance blogs. Third, there are the “profession observe” private finance blogs. After all there are extra classes resembling retirement blogs or I-won-the-lottery blogs, however these are the largest.

Drawn under is a graph depicting this triad.

The x-axis reveals spending. The y-axis reveals incomes. The diagonal line reveals the place earnings are equal to spending. Those that are in debt have been spending greater than they’ve been incomes and thus they lie under the diagonal line. “Graduates” (younger folks) have low earnings however hopefully additionally low spending. At that time in life there’s a tendency to spend as a lot as one earns since earnings are comparatively low. The most important group is what I for lack of a greater phrase name the profession observe blogs. Right here spending is 15% under earnings. This observe is sustained for 30-40 years as earnings and spending get progressively greater as a roughly fixed margin for the retirement plan is retained. Since one specific weblog reveals a snapshot in time of an individual’s funds, plotting all of the bloggers at one time replicate the everyday monetary path taken by an individual in our society. It seems like this. If there are any beginner astronomers studying this simply consider the similarities to the everyday evolution of a star on a Hertzsprung-Russell diagram. No, there is no such thing as a hidden cosmic significance right here

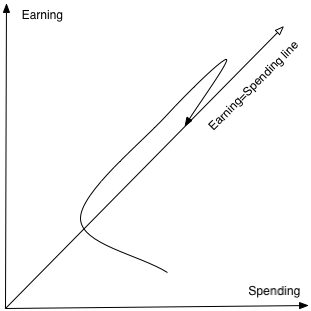

The x-axis reveals spending. The y-axis reveals incomes. The diagonal line reveals the place earnings are equal to spending. Those that are in debt have been spending greater than they’ve been incomes and thus they lie under the diagonal line. “Graduates” (younger folks) have low earnings however hopefully additionally low spending. At that time in life there’s a tendency to spend as a lot as one earns since earnings are comparatively low. The most important group is what I for lack of a greater phrase name the profession observe blogs. Right here spending is 15% under earnings. This observe is sustained for 30-40 years as earnings and spending get progressively greater as a roughly fixed margin for the retirement plan is retained. Since one specific weblog reveals a snapshot in time of an individual’s funds, plotting all of the bloggers at one time replicate the everyday monetary path taken by an individual in our society. It seems like this. If there are any beginner astronomers studying this simply consider the similarities to the everyday evolution of a star on a Hertzsprung-Russell diagram. No, there is no such thing as a hidden cosmic significance right here

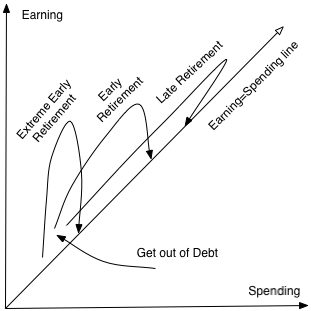

An individual on this diagram might begin in debt or on the spending=incomes line. As earnings go up financial savings are steadily elevated to fifteen% at which level they’re held fixed. As earnings maintain going up spending is adjusted accordingly. After 30 or 40 years, the individual retires with a modest drop in spending (no cafeteria lunch and no commute).This path is how most individuals assume on the subject of private finance. Different paths might sound unusual and even inconceivable.Listed here are another paths. That hopefully places every part in perspective.  It’s seen that the everyday path above is only one of a number of potential path. The standard path corresponds to going into scholar debt, then getting a profession for 30-40 years finally paying off the debt and accumulating a big sum of money (ideally 1-2 million {dollars} in retirement funds) after which retiring at a excessive spending stage which little concern for a way the cash is spent.Early retirement may be reached by way of maybe modest scholar money owed however saving considerably extra at a charge of 30-50% for 15-20 years at which level early retirement is feasible at age 40-50. This does require some finances management to hold by way of.Excessive early retirement is reachable with even smaller scholar money owed (or maybe no scholar money owed) and saving 50-80% for 5-10 years. This makes it potential to retire between ages of 30 and 40. This requires substantial cash administration and frugality abilities.The 2 conclusions to be drawn right here is that by observing a big group of non-public finance bloggers one can get an concept of how an individual (a blogger to be precise) sometimes behaves over a lifetime. One the opposite hand one must also examine “unusual” blogs to see what different paths are potential.

It’s seen that the everyday path above is only one of a number of potential path. The standard path corresponds to going into scholar debt, then getting a profession for 30-40 years finally paying off the debt and accumulating a big sum of money (ideally 1-2 million {dollars} in retirement funds) after which retiring at a excessive spending stage which little concern for a way the cash is spent.Early retirement may be reached by way of maybe modest scholar money owed however saving considerably extra at a charge of 30-50% for 15-20 years at which level early retirement is feasible at age 40-50. This does require some finances management to hold by way of.Excessive early retirement is reachable with even smaller scholar money owed (or maybe no scholar money owed) and saving 50-80% for 5-10 years. This makes it potential to retire between ages of 30 and 40. This requires substantial cash administration and frugality abilities.The 2 conclusions to be drawn right here is that by observing a big group of non-public finance bloggers one can get an concept of how an individual (a blogger to be precise) sometimes behaves over a lifetime. One the opposite hand one must also examine “unusual” blogs to see what different paths are potential.

Copyright © 2007-2023 earlyretirementextreme.com

This feed is for private, non-commercial use solely.

Using this feed on different web sites breaches copyright. If you happen to see this discover wherever else than in your information reader, it makes the web page you’re viewing an infringement of the copyright. Some websites use random phrase substitution algorithms to obfuscate the origin. Discover the unique uncorrupted model of this publish on earlyretirementextreme.com. (Digital Fingerprint: 47d7050e5790442c7fa8cab55461e9ce)

Initially posted 2008-02-28 07:18:59.

[ad_2]