[ad_1]

Excellent news for wages and Social Safety tax base, however will prices keep flat?

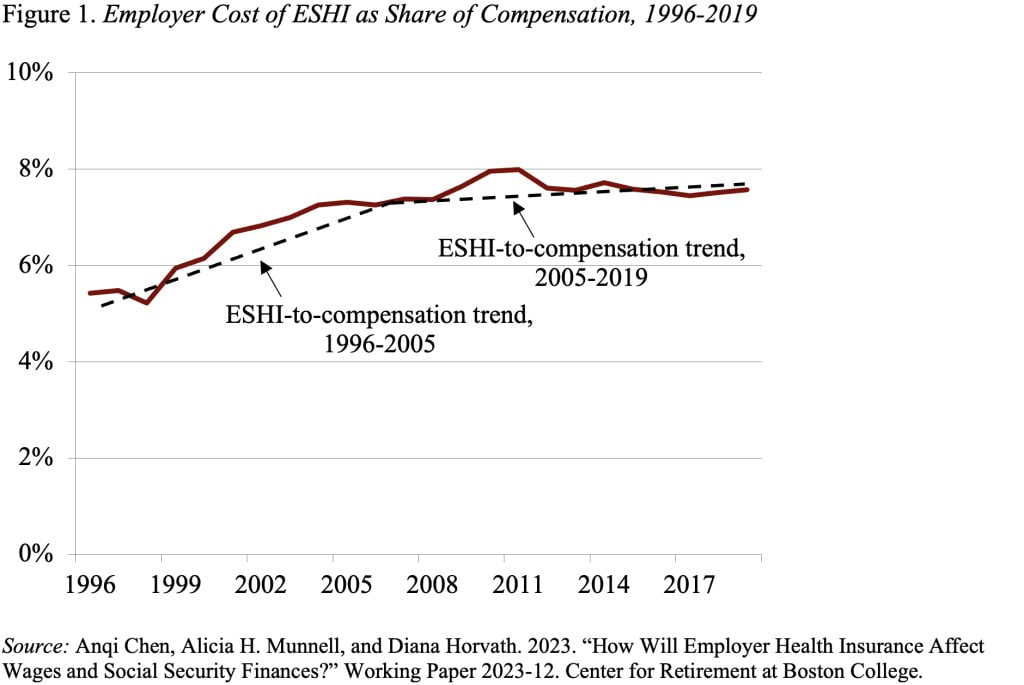

Well being care prices are a big and rising share of the nation’s GDP. A method these prices feed into the final economic system is thru employer contributions to employer-sponsored medical insurance (ESHI). Economists typically assume that the prices of employer advantages – on this case medical insurance – are handed onto the worker, resulting in slower wage progress and thereby the erosion of the Social Safety wage base. Each these results have been evident within the a long time earlier than 2005, as ESHI elevated as a share of compensation. Thankfully, the ratio of ESHI contributions to compensation plateaued after 2005, stabilizing wages and halting the erosion of the share of labor compensation topic to Social Safety’s taxable base (see Determine 1).

The query is whether or not the stabilization of employer contributions as a share of compensation is non permanent or everlasting. To reply that query my co-authors and I got down to decide why ESHI contributions rose as a share of compensation previous to 2005 and why this ratio stabilized lately. We then used these findings to mission doable ratios of ESHI to compensation over the following decade.

The literature identifies three main components that drive the price of ESHI as a share of compensation:

- Nationwide Well being Expenditures: Basic tendencies in healthcare spending are, not surprisingly, an necessary driver. These expenditures elevated from about 13 p.c of GDP within the mid-Nineties to round 17 p.c of GDP in 2009, plateauing round this degree via 2019.

- Make-up of Contributors: Since the price of medical insurance as a share of compensation is increased for decrease earners than for increased earners, a decline in participation amongst decrease earners decreases the employer’s total ratio of ESHI prices to compensation.

- Household vs. Particular person Protection: Household plans are considerably costlier than particular person plans, and their prices have grown at a sooner tempo. To the extent that household plans as a share of complete plans declines, prices relative to compensation will drop.

Utilizing knowledge from Division of Well being and Human Providers’ Medical Expenditure Panel Survey (MEPS), our evaluation confirmed that the expansion in nationwide well being expenditures was, certainly, the main driver of the ESHI-to-compensation ratio each earlier than and after 2005. After 2005, nonetheless, this affect was largely offset by the decline in participation amongst decrease earners and the decline in demand for household plans.

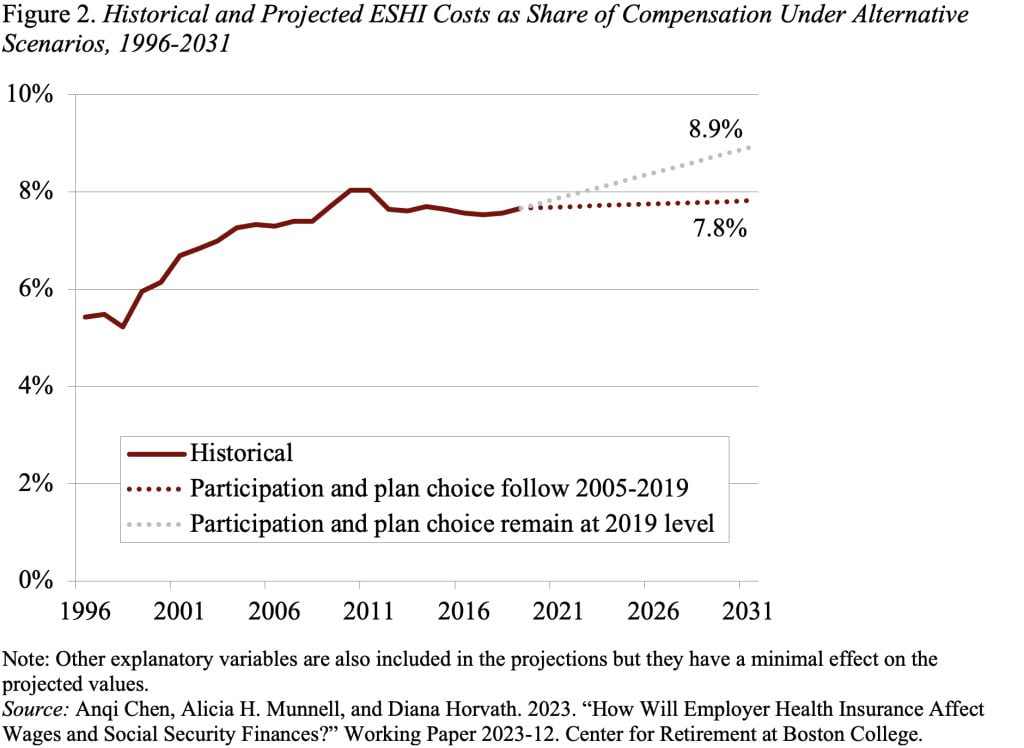

Trying ahead, the Facilities for Medicare & Medicaid Providers mission that nationwide well being expenditures as a share of GDP will improve from 17.6 p.c in 2019 to 19.6 p.c in 2031. If nothing else adjustments, ESHI as a share of compensation will improve as effectively. However, if ESHI participation and demand for household plans decline as they’ve lately, these two components ought to offset the expansion in healthcare expenditures and the ratio of ESHI to compensation ought to stay steady (see Determine 2).

[ad_2]