[ad_1]

If you wish to discover a place the place homes stay inexpensive, strive Syracuse, New York. It’s a school city, so it’s most likely a pleasant place to stay.

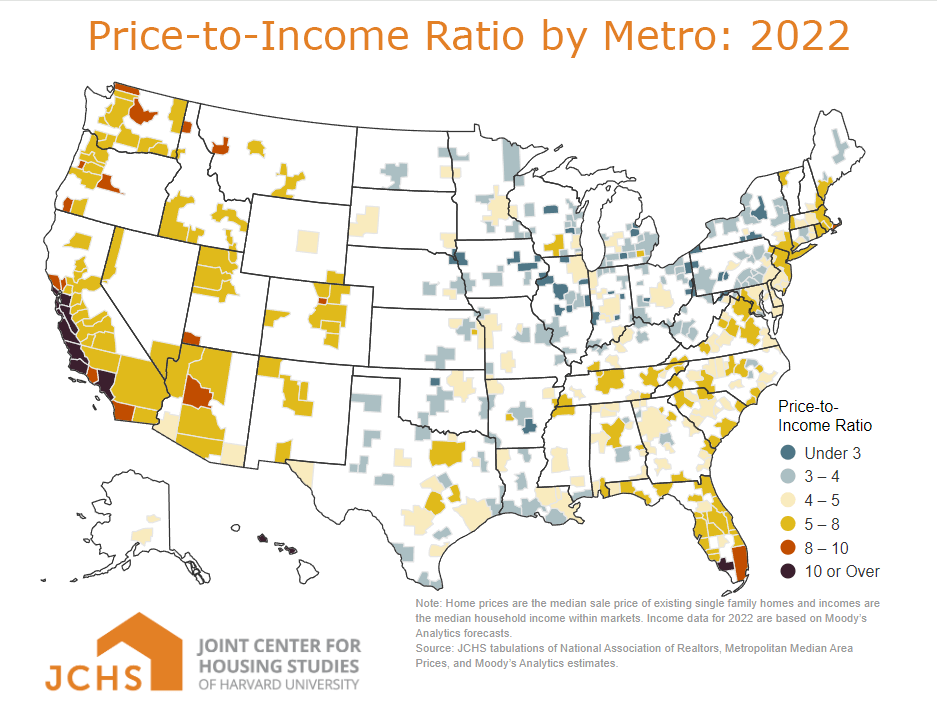

Syracuse is the one giant U.S. metropolis the place the price of a typical house is lower than thrice the family earnings of residents in that space, in line with a new report by Harvard’s Joint Heart for Housing Research. U.S. Information & World Report named it one of many prime locations to stay, and an enormous motive was affordability.

“Value-to-income ratios that low had been the norm throughout a lot of the nation in prior a long time,” the middle defined. However not. The ratios are at their highest ranges because the Seventies.

In 2022, 48 of the 100 largest housing markets had costs that exceeded 5 occasions family earnings. In 2019, earlier than COVID, solely 15 markets had been that top. In a couple of locations, costs are at insane ranges, together with Honolulu and San Francisco, the place they’re 11 to 12 occasions native incomes.

House fairness is commonly staff’ and retirees’ largest type of wealth. However the pandemic has dealt a number of successive blows which have made homebuying – and constructing that essential type of wealth – more and more unaffordable.

Blame the excessive costs on the surge in demand in a sizzling housing market early within the pandemic. The hearth was fueled by unusually low rates of interest. Keep in mind all that purchasing exercise? Households traded as much as a much bigger home so mother and pop had an workplace aside from the place the youngsters had been zooming faculty. Metropolis residents packed up and moved to the suburbs or rural areas to flee COVID, bringing their big-city worth expectations and financial institution accounts with them. Buyers interested by profiting additionally jumped in, placing extra stress on costs.

Miami is a primary instance. Northerners moved to part of the nation the place safer out of doors actions are doable year-round. Home costs there are almost 9 occasions native incomes.

Pandemic demand was first. However then inflation hit. The Federal Reserve responded by climbing up rates of interest, and the speed on 30-year mortgages greater than doubled to almost 8 p.c. This eroded housing affordability by tremendously growing month-to-month mortgage funds. A home or apartment that may’ve been viable previous to the pandemic was all of the sudden out of attain.

Excessive rates of interest additionally had one other impact, miserable the stock of properties on the market and pushing up costs. Householders are nonetheless reluctant to promote a home backed by a low-rate mortgage and purchase a brand new place at a a lot steeper charge.

Extra not too long ago, mortgage charges have began dropping, however they’re nonetheless a lot larger than pre-COVID ranges. The consultants are usually not optimistic that the housing market will return to the times previous to the pandemic. Shopping for a home will proceed to be a battle in 2024.

Squared Away author Kim Blanton invitations you to observe us @SquaredAwayBC on X, previously often called Twitter. To remain present on our weblog, be part of our free electronic mail record. You’ll obtain only one electronic mail every week – with hyperlinks to the 2 new posts for that week – while you join right here. This weblog is supported by the Heart for Retirement Analysis at Boston School.

[ad_2]