[ad_1]

Wish to be extra intentional together with your spending so you realize your cash is working on your objectives? Or do you battle with overspending and consistently neglect to replace your finances? Qube Cash stands out as the good answer for you!

Early in 2021 my husband and I made the primary change to our budgeting system in 11 years to hitch Qube Cash, a budgeting and digital banking answer. And we’ve each fallen in love with the system.

So, it’s time for me to share my full assessment of Qube so that you might be extra intentional together with your cash too!

Desk of Contents

What’s the Qube Cash App?

Qube Cash is a revolutionary app and banking answer that mixes the ability of digital banking with the intentionality of money envelope budgeting (with out all of the monitoring or pesky money.)

Qube Cash is a revolutionary app and banking answer that mixes the ability of digital banking with the intentionality of money envelope budgeting (with out all of the monitoring or pesky money.)

By creating “Qubes” (envelopes) in your Qube Cash account that you should open prior to creating a purchase order together with your card, you develop intentionality together with your cash and keep a real-time image of your spending plan.

Whereas different budgeting instruments, YNAB and EveryDollar, supply digital money envelope type budgeting, these apps aren’t tied to your precise spending. Which implies to remain correct, these instruments must be up to date for each transaction.

With Qube, you’ve got a digital checking account that’s tied to your spending classes, making your finances and your spending built-in seamlessly.

4 Causes We Love Qube Cash

As we’ve used Qube Cash, we’ve discovered many causes to like the app. Not least of which is that it’s saving us cash! However for this assessment, I’ve rounded up my prime 4 causes for selecting to make use of Qube for our household.

1 – Qube Cash is Proactive, not Reactive

Anytime you’re utilizing a budgeting app or software – even simply pen and paper – you’re reconciling what you’ve spent and the way a lot cash you’ve got after the actual fact.

This is the reason typically you sit right down to do your finances on Friday and also you notice, “Oh my goodness, I overspent on groceries once more!” And also you’re making an attempt to make changes to repair it after the actual fact.

With Qube, since you’re opening that Qube within the second, you realize that that cash is there. And if there’s not cash obtainable, you both want to alter your priorities and shift cash from one Qube to a different or simply notice you possibly can’t make that expense.

It stops it earlier than the transaction occurs!

That is the rationale that money envelopes have labored for therefore many individuals, apart from the truth that they’re extremely troublesome to handle. No one desires to hold money round. And naturally that’s a serious safety threat.

I really like that Qube offers you the power to be proactive and intentional together with your spending, whereas additionally avoiding the time dedication and headache of money envelopes.

2 – Qube Cash Makes Your Cash Safe

When you concentrate on spending with money envelopes or a debit card typically, your cash is in danger. In the event you lose your money or your card, somebody can simply spend your cash and you’ve got restricted protections. (Particularly as extra debit playing cards have Visa and Mastercard logos and don’t all the time require your pin to make a transaction.)

Whereas your Qube Cash card is a debit card, it’s default stability is $0. There may be nothing to spend on the cardboard till you open a Qube.

So, even when you misplaced your card or somebody received your account quantity, nobody would have the ability to make a transaction with no Qube being open.

There are additionally no overdrafts that means no overdraft charges!

The way in which the Qube card works, when you haven’t opened a Qube or there’s not sufficient cash within the Qube, it’s going to deny the transaction and you’ll strive once more. When a transaction fails, a notification pops up in your cellphone and provides you an alert that claims, “A transaction has been tried at Barnes & Noble however a Qube has not been opened. Would you wish to open a Qube?”

And it actually makes this complete factor safe and straightforward.

3 – Your Finances Is All the time Correct

With Qube, my finances’s accuracy isn’t depending on whether or not or not I’ve remembered to go in and replace transactions.

It doesn’t matter if I’ve been on trip and have forgotten for per week or two to go in.

It’s simply updated as a result of it’s instantly reconciling that expense as you spend. The app takes the cash out of the Qube you opened, making the transaction, and placing what’s left again in that very same Qube reflecting how a lot you’ve got left.

There is no such thing as a monitoring or categorizing bills, it occurs routinely as a part of the method. This protects us a lot time and let’s us make choices with persistently correct info.

4 – Qube Retains You On The Similar Web page With Your Associate

In most households, one particular person is the first supervisor of the finances. The opposite particular person’s data day-to-day is predicated on conversations which are had with the principle supervisor. (Or, after they aren’t had, points are prompted.)

It is going to shock nobody that in our home, the supervisor is me. Which implies that previously my husband would textual content me questions like, “How a lot is left within the grocery finances?” or “Do we now have cash for this software I want on the ironmongery shop?”

May he have regarded in YNAB? Certain. Nevertheless it discovered it very overwhelming and wasn’t positive after I had final reconciled the numbers in there. That means he didn’t know if he might belief these numbers.

Now, as a result of Qube is all the time correct, he feels rather more assured with and accountable for our spending.

Qube saves us time – each from monitoring and conversations that are actually unneeded – and cash as a result of we each know precisely the place the finances stands always.

It’s an exquisite factor!

How Qube Cash Works

To see an entire walkthrough of how Qube Cash works, from opening the app and funding your account to creating a purchase order, try this clip of our assessment video.

Step 1: Deposit Cash Into Your Qube Account

Once you first arrange your Qube account (issued by Selection Monetary and FDIC insured), you’ll have a one-time alternative to do a free “On the spot Deposit” of $25 to $100. This makes use of a debit or bank card to immediately add cash to your Qube account and provide help to get began utilizing the app.

After this On the spot Deposit, you need to use an ACH switch, direct deposit, or money app to fund your account.

This sediment will go into your “Qube Cloud” and can must be moved into spending Qubes to be spent together with your card. So the subsequent step is establishing your Qubes!

Step 2: Set Up Your Spending Qubes

Now it’s time to decide which Qubes you need in your account. With the free plan, you rise up to 10 Qubes however with the Premium account you’ve got limitless Qubes.

Nice beginning choices are Groceries, Eating Out, Clothes, or Enjoyable Cash, as these are usually many individuals’s drawback accounts. However you select what works for you!

Step 3: Allocate Your Funds

Head to your planning tab (decrease left nook) and add cash to your Qubes. As you add cash, you’ll see a complete on the prime displaying you ways a lot you’re including complete throughout all Qubes versus what’s at the moment in your Qube Cloud.

Once you’re prepared, hit “Fund Qubes”! Now you’re able to spend.

Step 4: Spend With Objective!

Now that the cash is in your Qubes, you possibly can spend it as you want together with your debit card, Apple Pay, Google Pay, or different digital wallets like Walmart Pay.

Merely faucet the Qube you need to spend from to open the Qube (hitting the quantity within the Qube opens it routinely). The cash from that Qube is added to your Qube card in seconds. Then, merely faucet your cellphone or card to buy!

The quantity remaining in your Qube after the transaction is moved again into that Qube so your card as soon as once more has a zero greenback stability till you open one other Qube.

Your spending plan will all the time be updated and also you’ll be spending deliberately!

You Do not Have to Look forward to Your Qube Card to Spend!

As quickly as your Qube account is created, you’re issued a card quantity which yow will discover by clicking the three strains within the decrease proper then clicking “Card Data”.

By including your card quantity, expiration date, and safety code to Apple Pay, Google Pay, or whichever digital pockets you utilize, you can begin spending the identical day you be a part of Qube!

How A lot Does Qube Cash Price?

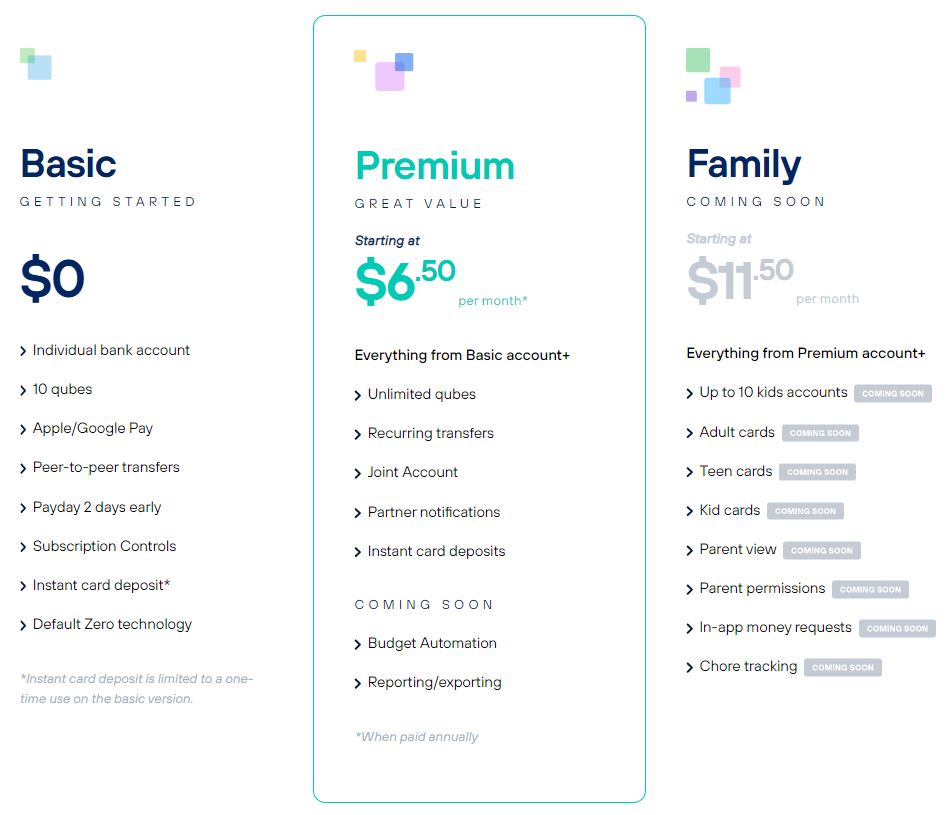

Qube Cash at the moment provides two ranges of service with a 3rd on the best way.

Qube Cash begins with a free plan that gives a person checking account, 10 spending Qubes, subscription controls, and extra.

Their Premium plan provides joint accounts, limitless Qubes, invoice pay Qubes, and recurring transfers. It prices $8/mo or $78/yr if paid yearly. That is the plan I’m on, as my husband and I needed a joint account and extra Qube choices.

The Household Plan continues to be within the works, however will add as much as 10 child accounts, child and teenage playing cards for managing allowance and children’ spending cash, and mum or dad permissions. We’re wanting ahead to this, as digital allowance is a implausible lesson for teenagers who should handle cash in a digital age. And I love with the ability to maintain us all engaged on the identical platform.

Qube Cash Options You Cannot Miss

Simply the power to trace our Qubes and have this digital money envelope system that connects with our debit card and stops us earlier than we make an expense is sufficient motive to fall in love with Qube. However there have been just a few particular options that we predict may have you speeding to obtain the Qube Cash app too!

Amazon Transaction Qube

Anybody who has ever budgeted earlier than is aware of the ache of categorizing Amazon transactions.

One buy can really be processed at a number of instances and in numerous quantities, based mostly on when objects are shipped. So, while you see an Amazon transaction in your account after the actual fact, it’s onerous to know what merchandise it’s with out downloading all your invoices. (As a result of the transaction quantity isn’t the identical quantity as your order worth.)

Not with Qube!

Qube has an computerized Amazon Orders Qube. Once you’re about to put an Amazon order, you open a Qube and hit “Spend” (little inexperienced field with an arrow to the best). Hit “Amazon Order” and enter the full quantity together with tax.

This with authorize that complete buy quantity to Amazon, from the class you’re spending from, and the Amazon Orders Qube will handle approving these transactions routinely as they arrive by way of.

You may even fund your Amazon Orders Qube from a number of spending Qubes, when you’re buying objects that must be lined from a number of classes.

No dealing with it after the actual fact or clicking by way of invoices!

Pre-Authorization Function

If Qubes need to be open for a transaction to undergo, how do you deal with transactions the place you don’t know precisely when they’ll course of? The pre-authorization function!

We’ve got a Grove Collaborative subscription for our cleansing and family provides. However the worth of that order modifications every month based mostly on what we’d like. So, after I affirm my order with Grove for the month, I merely pre-authorize a transaction of that quantity from our Family Items Qube. Then, when Qube sees a transaction of that quantity come by way of, it routinely opens the Qube and processes the order, matching it with the pre-authorization.

However you need to use this function for planning as nicely!

Once you create a pre-authorization, it reduces the cash obtainable within the associated Qube by that quantity. That approach, you don’t overspend and find yourself not capable of cowl the pre-authorized expense sooner or later.

So, when pals name to ask us out to dinner in two weeks, I merely create a pre-authorization for a way a lot I anticipate to spend at dinner, identify it for our pals, and successfully put aside that cash.

It retains us from ordering takeout 4 nights earlier than our dinner date (as a result of we’ve forgotten, clearly) and ending up over finances.

Subscription Administration

Qube has Invoice Qubes to allow you to handle recurring transactions. You may fund your invoice Qubes with the quantity of the invoice, set the quantity and due date, and Qube will make sure you course of the transaction on that date.

This makes positive that payments are paid on time and that you simply aren’t overcharged!

But, it has a particular ability with regards to subscriptions like Netflix, Hulu, or every other membership.

Just lately, I had a sticker membership I needed to check. (Market analysis for my facet hustle, Wildly Sufficient.) Properly, after a month I requested for it to be cancelled. They mentioned it was, however I used to be charged once more the subsequent month. And once more the subsequent month. So, after arguing with them for a refund twice I merely turned off the Invoice Qube for that subscription.

Qube gained’t course of anymore funds, which can shut down my membership. Simple peasy. You will have complete management of who will get paid and when.

On the spot Inner Transfers

We set our budgets with the very best intentions. However, life occurs. What can I say, we aren’t fortune tellers.

So, when it seems you want more cash for Gasoline or Groceries, merely assessment by which money you might need a little bit additional money. Then, make an inside switch between Qubes to place your cash the place you want it.

Inner transfers are instantaneous, so you may make the acquisition you should immediately and keep it up together with your day.

Your finances must be versatile as a result of life is unpredictable. On the spot inside transfers makes that attainable.

Drawbacks of Qube Cash

No cash administration is ideal and consistently searching for one that’s will maintain you switching round till the tip of time. (And never really constructing a constant intentional spending behavior.)

As a substitute, you should discover a system that’s drawbacks are greater than offset by it’s advantages. And you can work with in your life. So, let’s tackle among the drawbacks of Qube.

1 – Cannot Spend With Credit score Playing cards

Once you’re spending together with your Qube account, you’re utilizing a debit card and never gaining bank card factors. That is the primary concern we hear from folks new to Qube and when you’re not prepared to cut back your use of bank cards, Qube might not be for you.

However whereas bank card factors can assist you journey or achieve different rewards, analysis reveals that individuals who use bank cards spend considerably greater than individuals who don’t. Even when you pay your card off in full each month, you’re possible not aligning your spending together with your objectives and values as a lot as you can.

(Everybody issues this isn’t them, however strive utilizing Qube for 30 days and see the distinction. There are some fascinating psychological issues at play right here. I’d have sworn we had been very intentional with our cash however have been saving a whole lot of {dollars} a month extra since switching to Qube.)

Essentially the most you earn again from bank card rewards is often 1% to five%. I’d anticipate you’d save much more than that utilizing Qube, and may you possibly can put that financial savings in direction of what issues most to you.

2 – Qube Does not Present Holistic Image of All Your Cash

Qube solely accounts for cash in your Qube account and finances classes associated to your particular Qubes. It doesn’t present your financial savings accounts, different checking accounts, bank card bills, or funding accounts.

This will make it troublesome for folks to see the entire image of their monetary standing in the event that they use accounts aside from Qube.

We’ve discovered that Qube is the best possible choice to handle our day-to-day spending. All of our common spending classes (groceries, eating out, gasoline, medical, youngsters’ bills, household enjoyable, and so forth.) are managed in Qube.

However, for a longer-term and broader view of our cash, we nonetheless use YNAB. We merely have a line merchandise in YNAB for funding our Qube account. Qube saves us from having to replace all these little common bills in YNAB and YNAB lets us arrange long-term sinking funds and see our cash throughout all accounts.

In case your saving and spending outdoors of Qube is basically on auto-pilot, you might not want a second software. However you need to ensure you have a plan to get a full view of your cash.

Upcoming Options: Monitoring Qubes

Qube is engaged on releasing “Monitoring Qubes” that might let you monitor and categorize bills not made together with your Qube account. Different financial institution accounts, bank cards, and so forth.

The discharge date is just not but set, however there’s a answer to this limitation within the works.

3 – Qube Cash is a Comparatively New Firm

Qube Cash being a startup has many advantages. It means a software that’s progressive and altering the best way we finances and financial institution. And it doesn’t make your cash any much less safe. Your Qube account is issued by Selection Monetary Group and is totally FDIC insured as much as $250,000.

Nevertheless, Qube continues to be consistently releasing new options, responding to buyer requests for brand new instruments and improved interfaces, and rising. This will imply having to take care of slight modifications to how issues are completed inside the app.

I’ve discovered Qube straightforward to make use of with restricted bugs – and I’m excited to see lots of the new options Qube is rolling out (like their Household Plan and child accounts) however a quickly rising platform isn’t a cushty alternative for everybody.

Is Qube Cash Proper For You?

Nobody budgeting system is ideal for everybody. However I can say no doubt that Qube is saving my household time, cash, and sanity as we handle our most energetic spending classes.

I extremely suggest downloading the Qube Cash app and making an attempt it for 30 days (you even get two months of Premium free of charge with the code MONEYMAMA.) You may select simply two to a few of your most troublesome spending classes to maneuver to Qube. Then, after 30 days, contemplate how a lot you’ve saved and how you’re feeling managing these classes with Qube.

I’m assured you’ll be feeling extra accountable for your spending!

The publish Qube Cash Evaluate: Finest Digital Money Envelope App appeared first on Good Cash Mamas.

[ad_2]