[ad_1]

3 Tricks to Guarantee SSN Accuracy

For some background, companies should ship Copy A of Type W-2 to the SSA. The SSA then matches the worker’s identify and SSN towards its database. As soon as matched, the earnings data from the W-2 is recorded with the worker’s earnings historical past.

If the names and numbers don’t match …properly, you possibly can simply think about the headache for the employer and worker. Beneath are three tricks to catch any errors or unauthorized numbers to assist guarantee a seamless submitting course of.

1. Confirm Names

You’d assume verifying names could be easy, however you’d be shocked what number of misspellings, nicknames, and pointless titles find yourself on W-2 filings. In case you’re manually filling out types, enter the identify on the W-2 as proven exactly on the worker’s Social Safety card.

If you wish to scale back the HR carry, mandate that staff confirm their names and SSNs earlier than you shut out your books to organize W-2s.

Notice: If an worker modifications their identify mid-year, proceed to make use of their previous identify and have them contact SSA to replace their card. Utilizing the brand new identify earlier than the worker updates his or her information might stop the SSA from posting earnings to the worker’s earnings historical past.

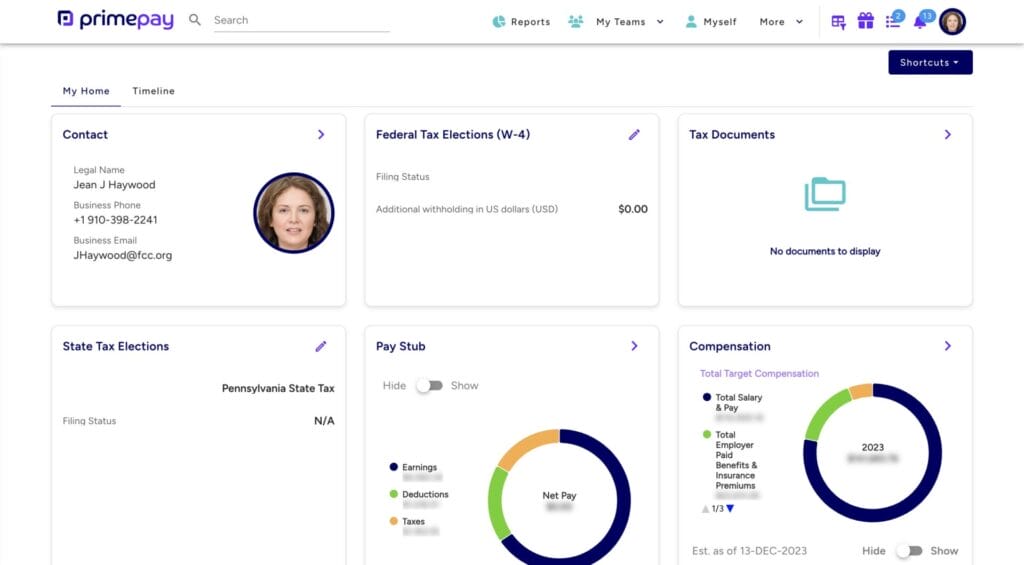

Workers can confirm their very own tax data by way of a self-service portal, which can enhance the effectivity of tax preparation and submitting.

2. Use On-line Assets

There are a couple of choices to confirm Social Safety numbers for wage reporting functions.

- The Social Safety Quantity Verification Service is a free on-line service that permits registered customers to confirm that the names and SSNs of employed staff match Social Safety’s information.

- The Consent-Primarily based Social Safety Quantity Verification Service is obtainable to enrolled personal firms and state and native businesses for a payment and gives instantaneous automated verification. It might additionally deal with giant quantity requests.

- E-Confirm is a free on-line system operated by the Division of Homeland Safety in partnership with the SSA. It permits employers to electronically confirm that their new hires are licensed to work within the U.S. by evaluating particulars on Type I-9 with Federal authorities databases. (In contrast to the primary two, this course of validates that your new rent is legally eligible to work within the U.S.)

3. Look to Your Payroll Software program

Your payroll software program supplier might routinely confirm worker SSNs – both throughout onboarding, earlier than submitting season, or each. By cross-referencing worker data with official databases, payroll software program helps organizations preserve compliance with rules, scale back errors in payroll processing, and stop fraudulent exercise … all with out the employer lifting a finger.

[ad_2]