[ad_1]

Let’s see if we agree on what the retirement age is at present.

With the projected depletion of the Social Safety belief fund property within the 2030s, policymakers are searching for methods to bridge the hole. One of many main proposals is to extend the retirement age. Actually, with common life expectancy rising, longer careers may very well be a technique to make sure an enough retirement with much less reliance on Social Safety.

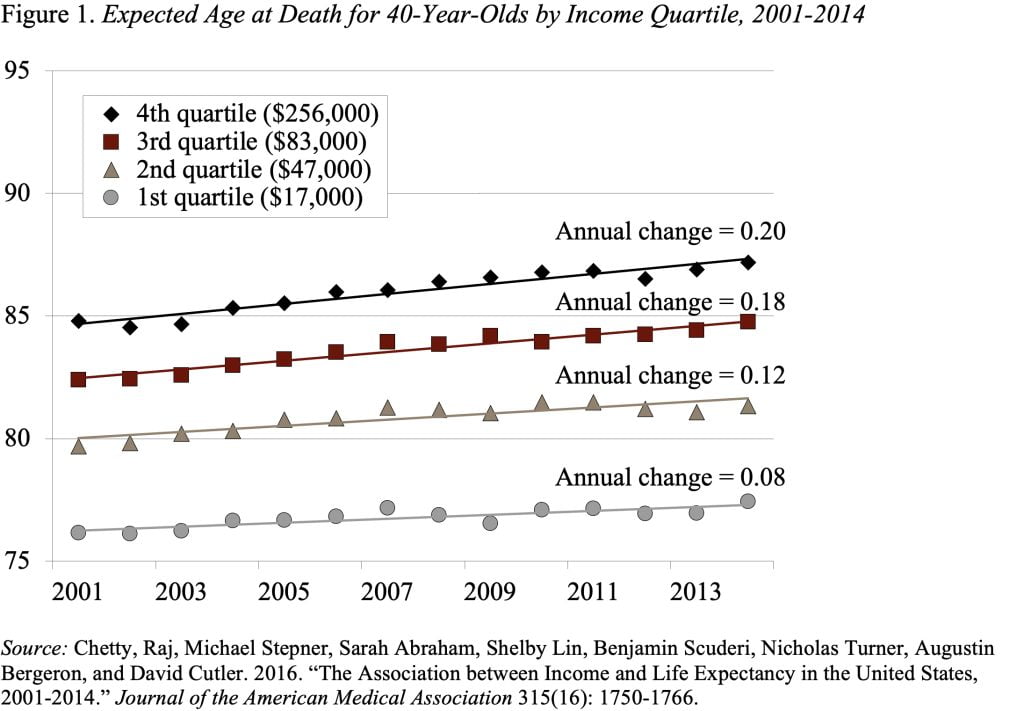

The issue is that life expectancy varies considerably throughout the earnings spectrum, and the positive aspects in life expectancy have been a lot higher for the rich than for the poor (see Determine 1). Thus, rising the retirement age across-the-board for all staff needs to be a non-starter. However incorporating later retirement into the system the place doable could avert sweeping modifications that would do hurt to the susceptible.

Earlier than we do something, nonetheless, we have to no less than agree on the retirement age within the present Social Safety system. At present staff can declare their advantages any time between 62 and 70. Advantages claimed earlier than age 70 are actuarially decreased, primarily based on common life expectancy. In different phrases, the claiming age impacts month-to-month advantages however, on common, is meant to not alter whole advantages paid over the lifetime.

Even supposing 70 is the age at which Social Safety pays the very best profit, the coverage dialog focuses on elevating the “Full Retirement Age” (FRA), which was the age at which staff obtained the very best lifetime advantages. For a very long time, the FRA was 65, however the 1983 Social Safety amendments elevated the FRA from 65 to 67 over a 23-year interval. The rise to age 66 was phased in between 2000 and 2005, adopted by an 11-year hiatus, and from 66 to 67 between 2017 and 2022.

Many recommend shifting the FRA greater. Elevating the FRA, nonetheless, is not only a query of “suspending” claiming for many who can work longer; it’s a profit lower. For instance, in comparison with when the FRA was 65, those that are capable of delay retirement to 67 obtain two years much less of advantages and people who can’t modify their retirement conduct get decrease advantages because of the elevated actuarial adjustment. Importantly, these pressured to assert at 62 used to obtain 80 p.c of the complete profit, however now they obtain solely 70 p.c. If the FRA had been elevated to age 70, that quantity falls to 55 p.c. So, altering the FRA is a blunt instrument that impacts each those that can work longer and people who can’t.

We’d like a distinct method. We have to establish the blokes who’re going to finish up within the fourth quartile of the earnings distribution and alter the foundations so they need to work longer to get their present advantages. The query is how to do this operationally. One possibility is to easily use, say, the very best 10 years of common listed earnings to establish the winners. However for the reason that ultimate rating isn’t completely clear until the tip of the sport, such an method could not go away staff with sufficient time to plan correctly. Another is to establish the retirement age primarily based on elements that happen early in life, resembling degree of schooling – the proof means that school graduates have the flexibility to retire a lot later than these with no school schooling.

The essential level is that the inhabitants isn’t homogenous. The extra privileged in our society live longer and more healthy lives; however the majority haven’t seen nice positive aspects in life expectancy, a lot much less in wholesome life expectancy. Let’s be intelligent right here and lift the retirement age for many who can work, with out doing any additional harm to those that can’t.

[ad_2]