[ad_1]

The temporary’s key findings are:

- Our 2023 Small Enterprise Retirement Survey appears to be like at why some small corporations provide a retirement financial savings plan and others don’t.

- Components that have an effect on whether or not small corporations provide a plan embrace agency dimension, wages, and business, in addition to beliefs on whether or not it’s going to assist appeal to staff.

- The principle obstacles to providing a plan are considerations in regards to the stability/dimension of the agency and the perceived prices of a plan.

- Considerations about prices are pushed by misperceptions; many corporations are unaware of lower-cost choices for employers and tax credit.

- The outcomes additionally recommend that state auto-IRA packages usually tend to encourage than discourage corporations from providing their very own plan.

Introduction

At any given time, solely about half of U.S. non-public sector staff are lined by an employer-sponsored retirement plan, and few staff save with out one. The protection hole, which undermines the retirement safety of the nation’s staff, is pushed by an absence of protection amongst small employers. Curiously, nonetheless, about half of corporations with lower than 100 staff do provide a plan for his or her staff. This temporary, which relies on a current examine, presents the outcomes of a brand new survey of small employers to know why some provide retirement plans and others don’t.

The dialogue proceeds as follows. The primary part describes the brand new survey and identifies elements that make a agency probably to offer protection. The second part experiences the obstacles that corporations understand to providing a plan and assesses the accuracy of those perceptions. The third part examines whether or not the presence of state-sponsored retirement packages – which usually require corporations with no plan to enroll their staff within the state program – shifts agency perceptions.

The ultimate part concludes that essential drivers to providing a plan, at the moment or within the close to future, are a agency’s beliefs, comparable to whether or not they suppose retirement plans matter for worker hiring and retention. Importantly, many employers with no plan maintain misperceptions in regards to the monetary and time prices of providing one. Subsequently, higher consciousness of the various out there choices for small corporations might assist shut the protection hole. Lastly, state-sponsored retirement packages usually tend to encourage than discourage the adoption of employer plans.

The 2023 Small Enterprise Retirement Survey

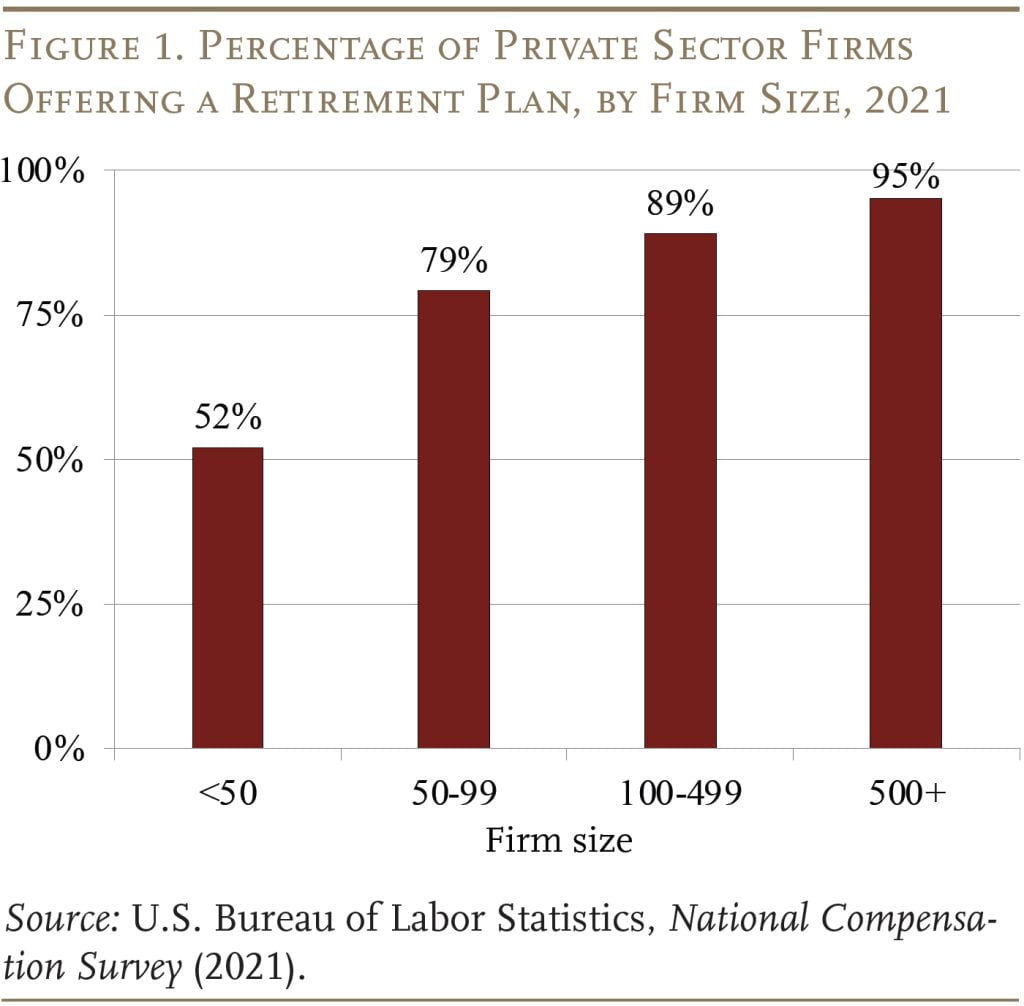

The 2023 Small Enterprise Retirement Survey, which was produced in collaboration with the Worker Profit Retirement Institute (EBRI) and Greenwald Analysis, was performed between February and April 2023 and consists of 703 corporations with 100 or fewer staff. This survey replicates the final main survey targeted on small enterprise retirement plans, which was performed in 1998 by EBRI and Greenwald Analysis. What is exclusive in regards to the 2023 survey is that it features a pattern of 100 corporations with 0-4 staff – a gaggle often excluded from surveys of small employers. Amongst all corporations sampled, 46 p.c provided a retirement plan, whereas the opposite 54 p.c didn’t. Since 92 p.c of all small corporations have fewer than 20 staff, this sample is pretty according to nationwide knowledge (see Determine 1).

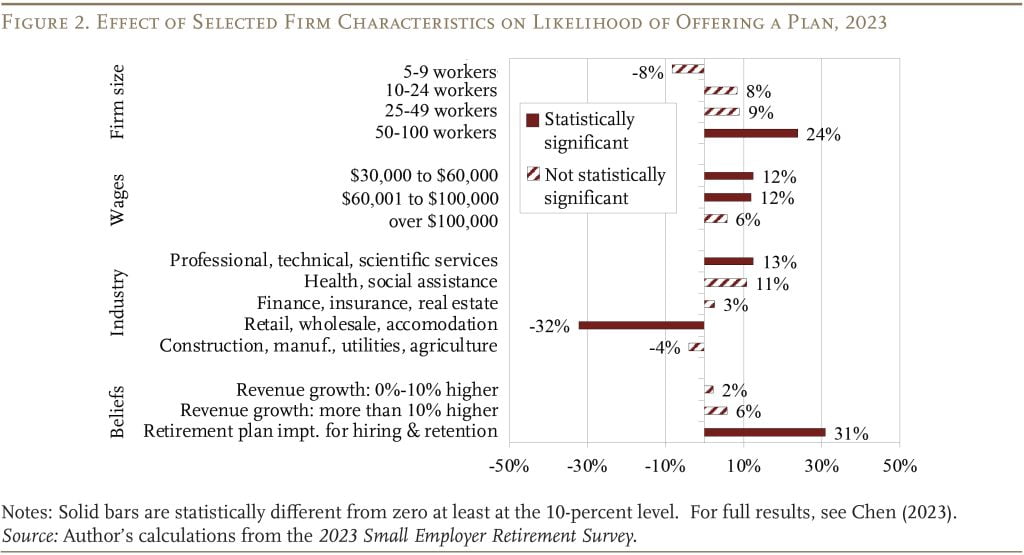

The survey responses can relate varied elements to the chance of a agency providing a plan (see Determine 2). As anticipated from earlier research, corporations with 50-100 staff, these with greater common salaries, and corporations in skilled, technical, and scientific providers industries are more likely to supply a retirement plan. In the meantime, corporations in retail gross sales, wholesale gross sales, and lodging (hospitality and meals providers) are a lot much less prone to provide a plan. However different elements additionally mattered. Beliefs about whether or not having a retirement plan is essential for hiring and retaining good staff are additionally a robust driver. Notably, a agency’s beliefs about income progress had little to no impact on having a retirement plan. Curiously, for corporations with no plan, beliefs are additionally an essential predictor of their chance of adopting a plan within the close to future.

What Retains Companies from Providing a Plan?

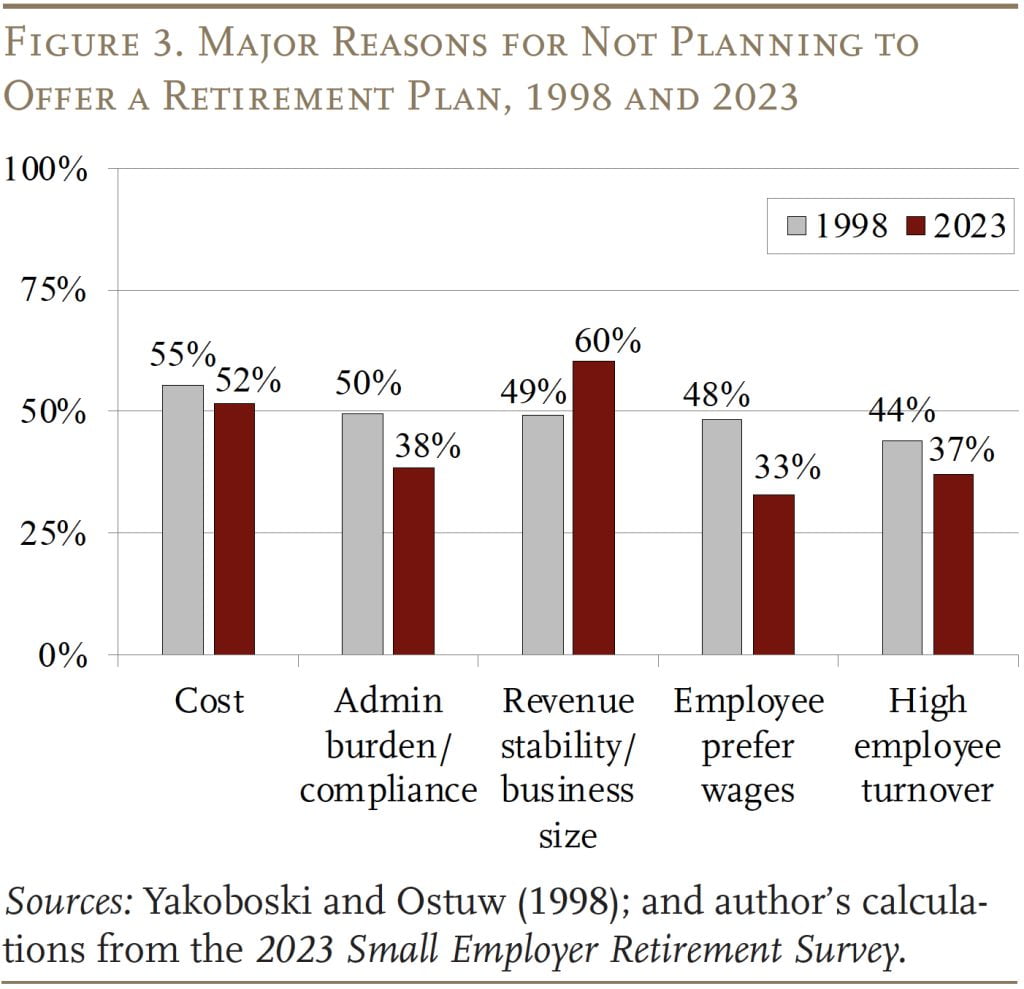

Traditionally, small corporations that don’t provide a plan have cited three major causes: 1) unsure revenues; 2) prices; and three) worker preferences for wages. The third purpose, worker preferences for wages, has dropped down the listing, however prices stay essential, whereas considerations about income stability/dimension have grown to turn into the most important barrier (see Determine 3).

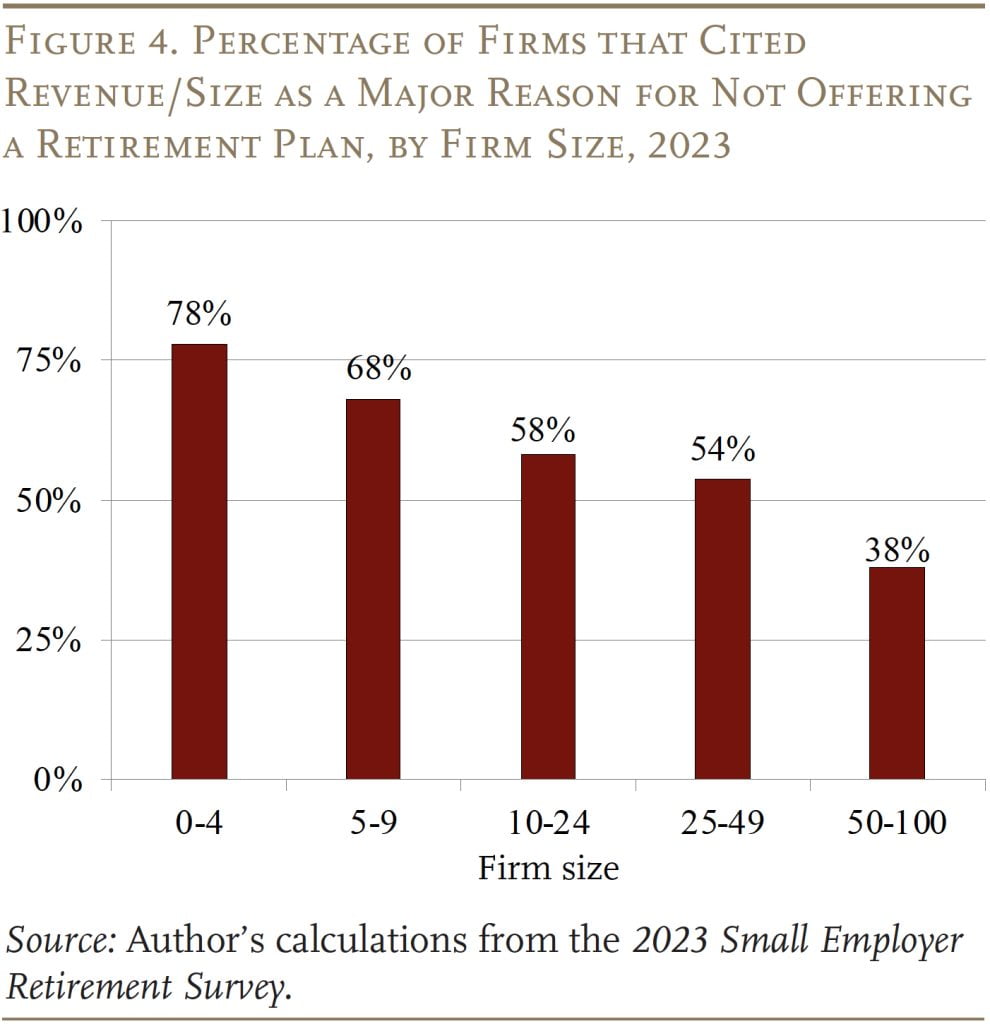

As one would anticipate, concern about revenues declines as agency dimension will increase (see Determine 4). Certainly, near 80 p.c of corporations with 0-4 staff cited income and dimension as a significant barrier to providing a plan. The smallest of those small corporations might merely have an excessive amount of on their plate so as to add an extra profit. For established corporations, prices and administrative burdens turn into crucial issue for not providing a plan.

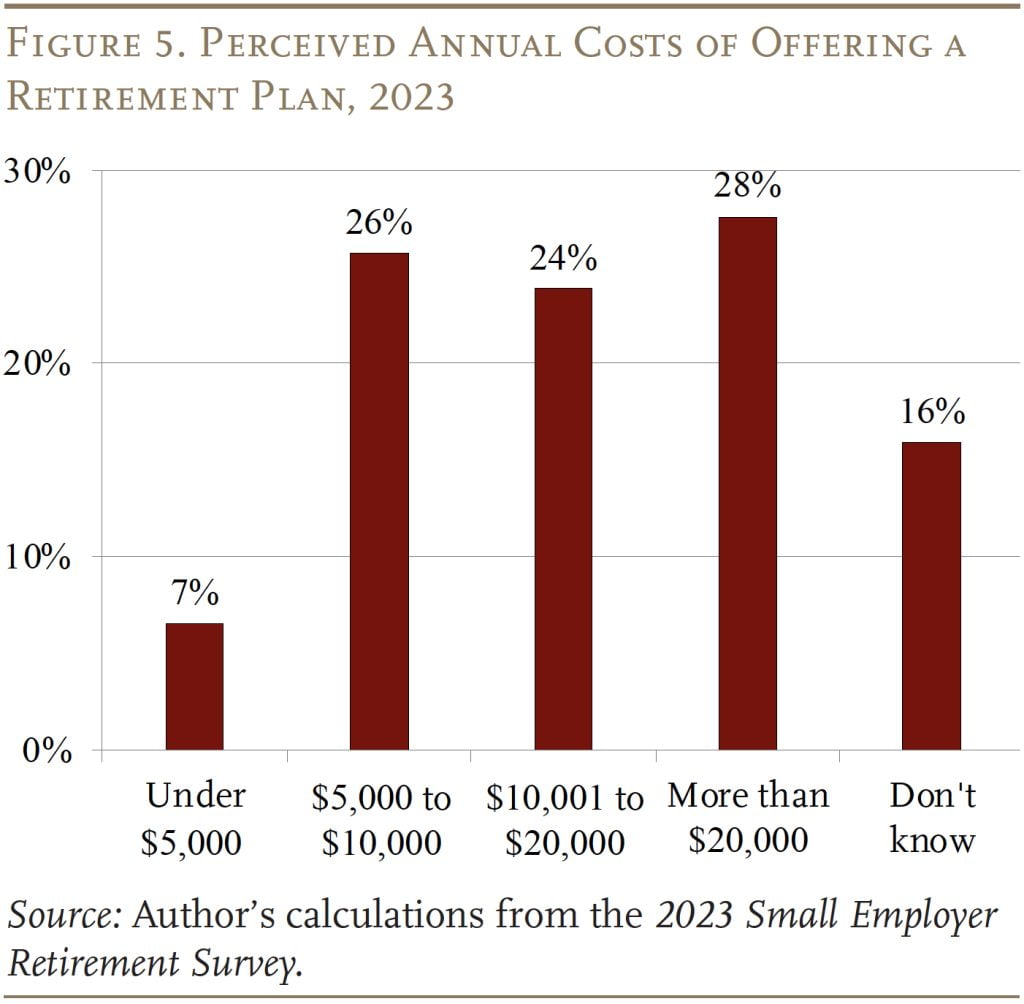

Curiously, most corporations surveyed that cite prices and administrative burden/compliance as obstacles do not need a very good sense of how a lot cash or time is definitely required to arrange a plan. A fast Google search yielded a number of 401(ok) choices the place annual employer prices would solely be about $2,500 for a agency with 10 staff and $5,000 for a agency with 50 staff. However, over half of small corporations consider offering a retirement plan would value greater than $10,000 per yr; and practically 30 p.c suppose it will value greater than $20,000 per yr (see Determine 5).

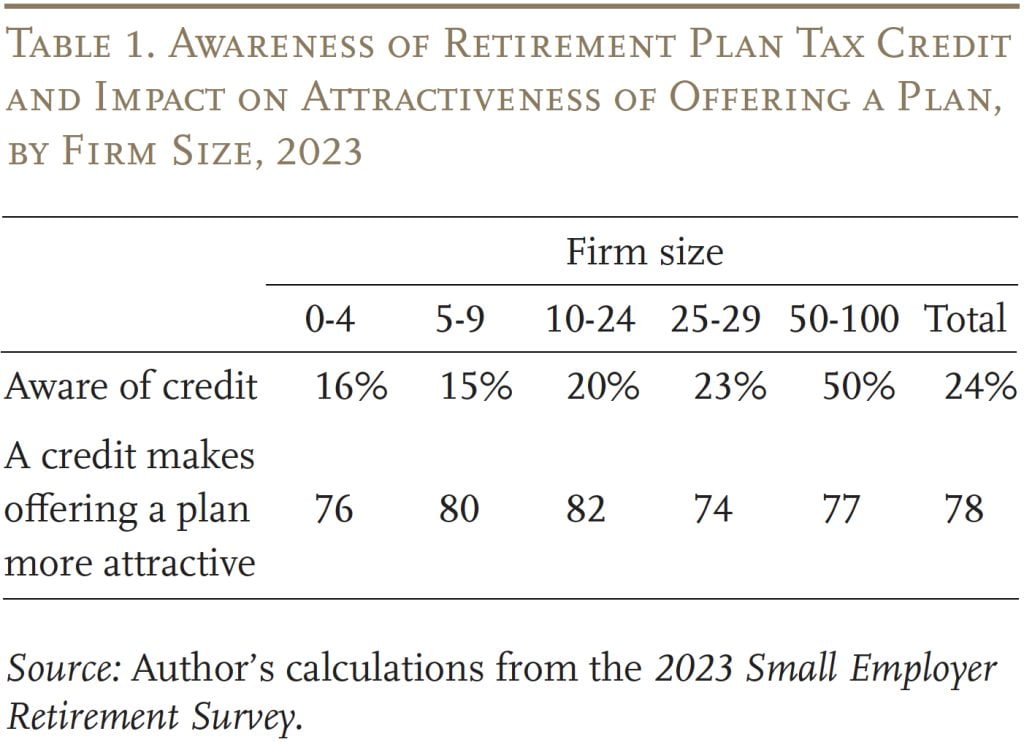

Not solely do small corporations overestimate the price of providing a plan, however the overwhelming majority – notably these with fewer than 50 staff – usually are not conscious that they’ll declare a tax credit score of as much as $5,000 for 3 years to assist offset the prices of beginning a plan (see Desk 1). Curiously, about 80 p.c of employers say that such a credit score would make providing a plan extra engaging.

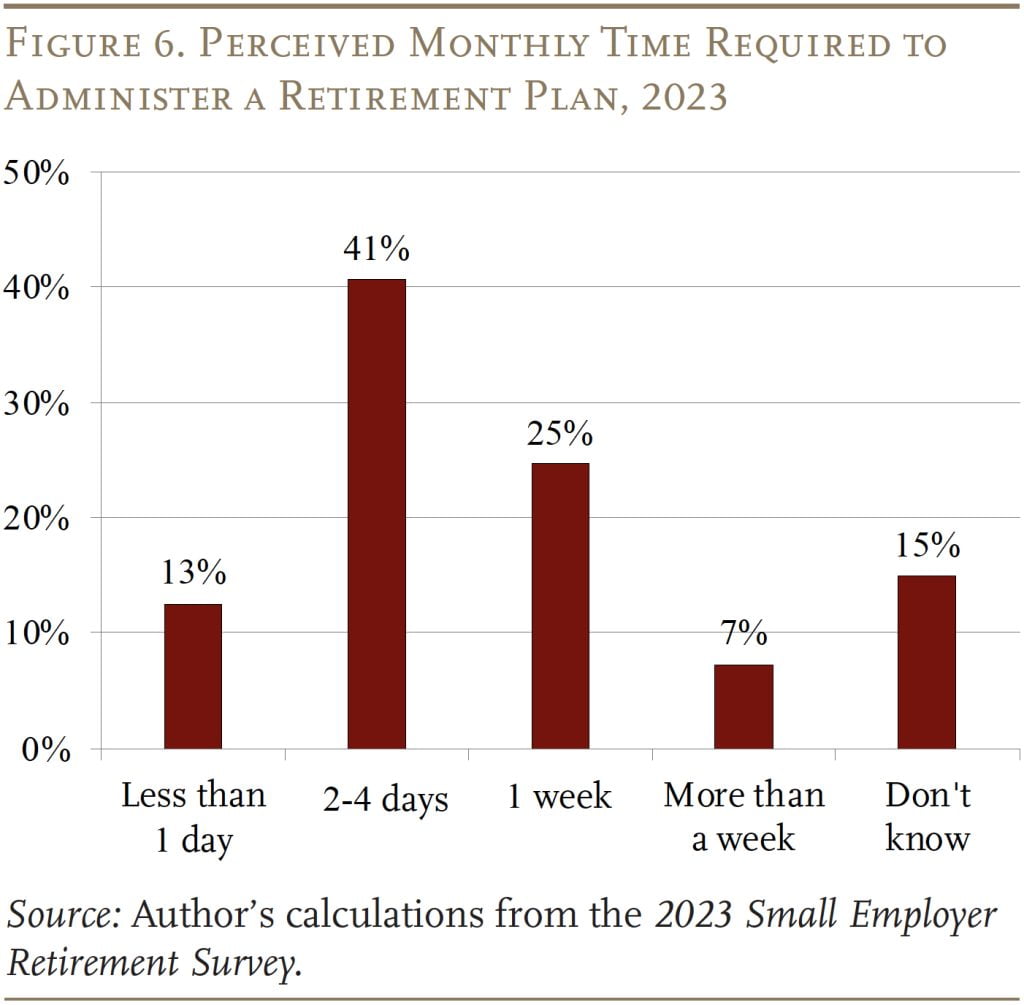

Moreover, small corporations do not need a very good sense of how a lot time it will take to manage a retirement plan (see Determine 6). Most corporations consider it will take a number of days to a complete week each month. However in actuality, after the preliminary set-up, working a retirement plan ought to solely take a couple of hours a yr.

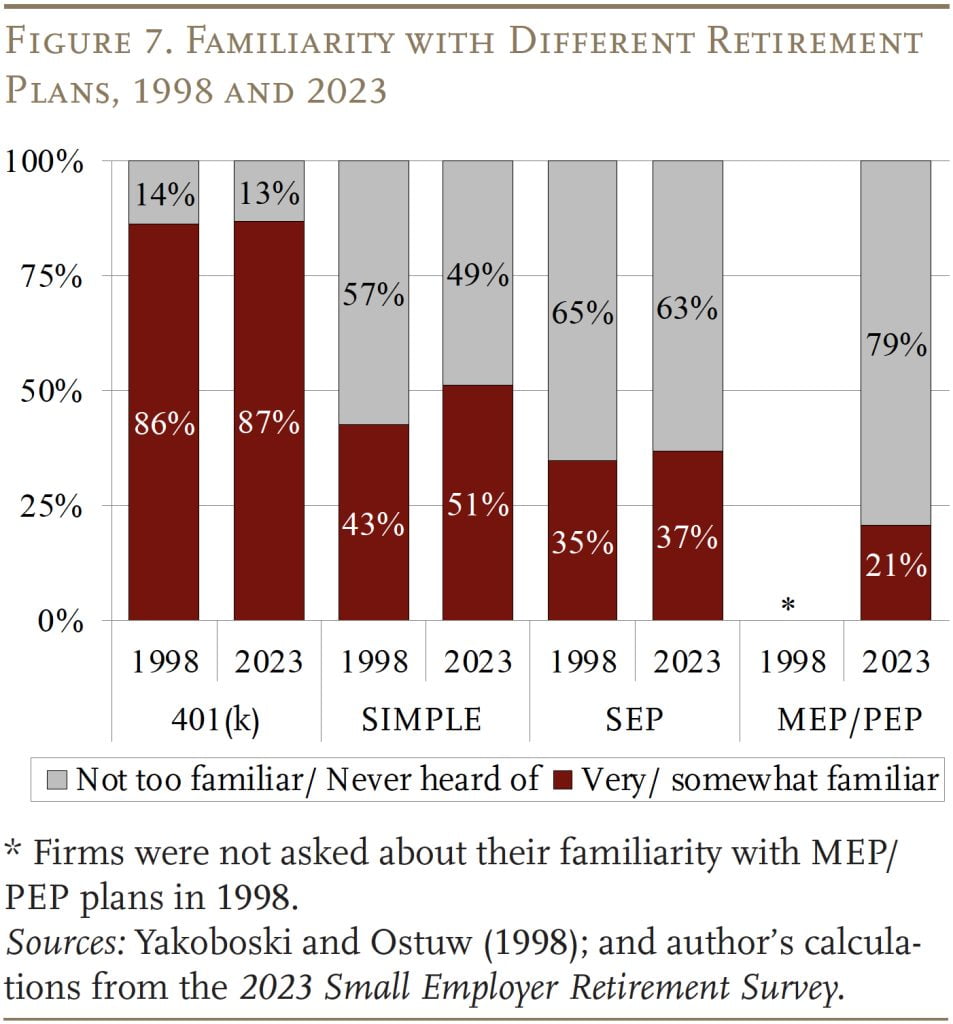

Many small corporations are additionally unfamiliar with the assorted retirement plan choices which might be designed to assist ease the fee and administrative burden of providing a plan. Whereas most small corporations are at the very least considerably conversant in 401(ok)s, the overwhelming majority usually are not conversant in SIMPLE, SEP, and MEP/PEP plans (see Determine 7). And this share has barely budged within the final 25 years.

These outcomes recommend that many corporations overestimate the monetary and time prices required to supply a plan, so higher consciousness of precise prices in addition to out there choices might assist scale back the obstacles that small corporations understand.

Will State-sponsored Packages Affect Agency Habits?

At present, 14 states have launched or are getting ready to launch packages requiring employers with no plan to mechanically enroll their staff in an Particular person Retirement Account (“auto-IRAs”). The survey requested all employers within the pattern – not simply these in states with auto-IRAs – whether or not the presence of such a program would make them much less or extra prone to have their very own plan.

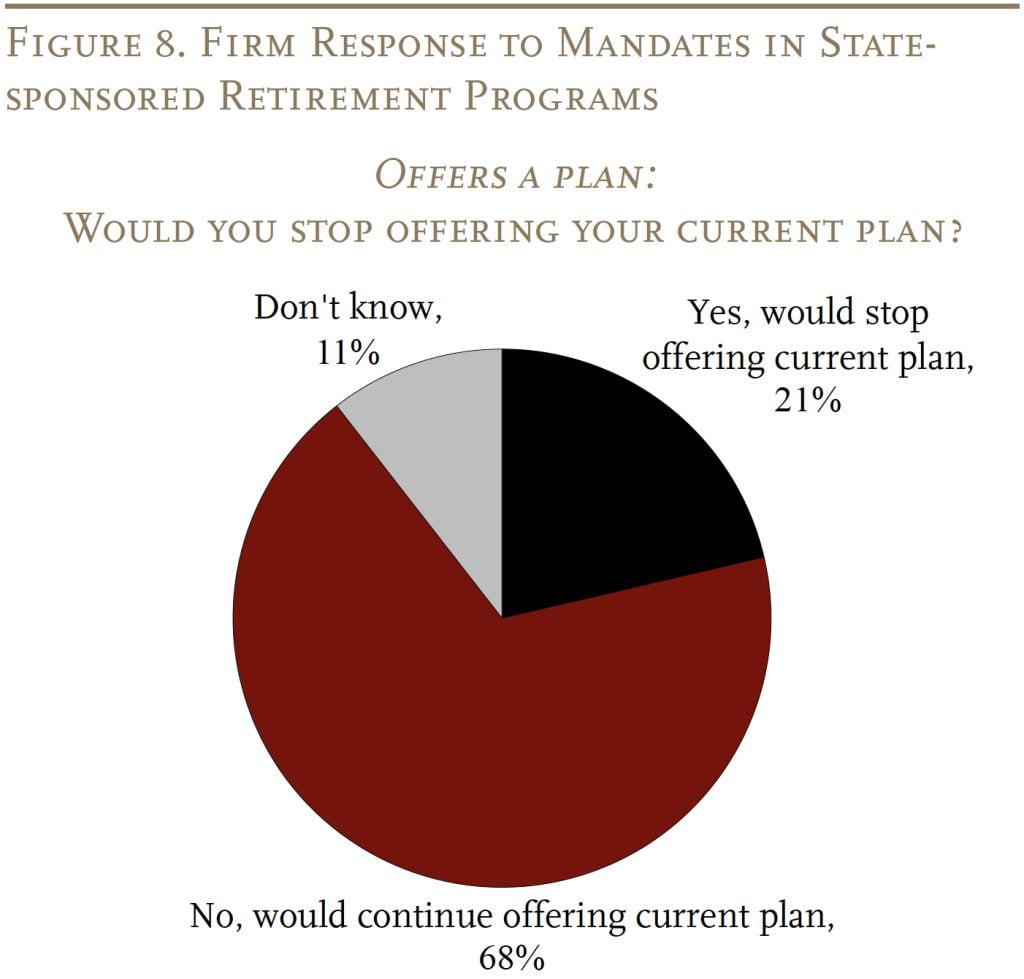

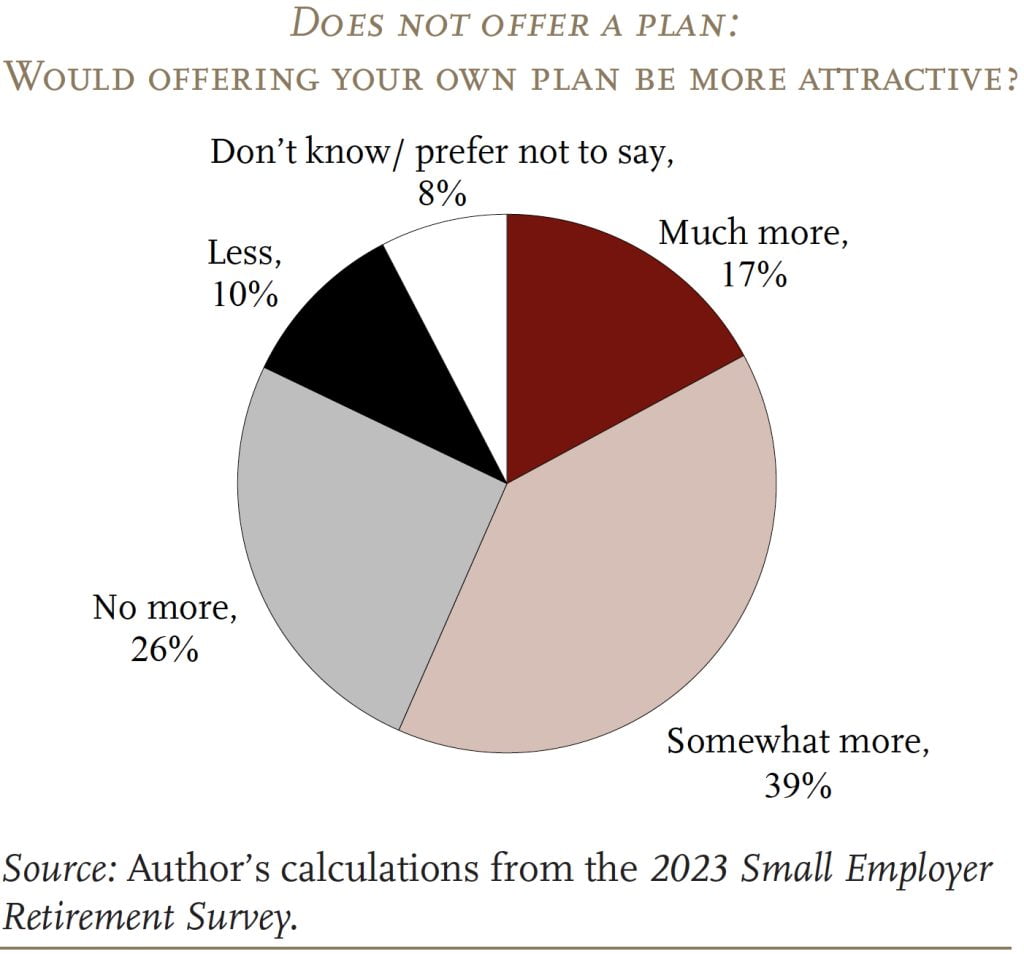

The outcomes present that, total, the presence of state-sponsored packages doesn’t make corporations much less prone to provide their very own retirement plan (see Determine 8). Amongst corporations that already provide a plan, about 70 p.c say they might proceed to supply their very own if their state launched a mandate. Amongst corporations that didn’t provide a plan, virtually 60 p.c mentioned a mandate would really make providing their personal retirement plan extra engaging.

Conclusion

The protection hole is a urgent concern for the nation’s retirement revenue safety, and the hole is pushed by small employers. As a way to encourage progress in protection, you will need to perceive the traits of small corporations that do and don’t provide a plan.

For corporations that provide or are contemplating providing a retirement plan within the close to future, their beliefs are essential – comparable to whether or not they suppose retirement plans matter for worker hiring and retention.

For corporations that don’t provide a plan, two main longstanding obstacles – income stability/dimension and prices or administrative burden of getting a plan – stay prime considerations amongst small corporations immediately.

Income considerations are extremely related to agency dimension, notably corporations with fewer than 10 staff. It’s comprehensible that corporations might have to turn into established earlier than organising a office retirement plan is seen as a viable possibility.

Views on value or administrative burdens, nonetheless, appear to be pushed by misperceptions in regards to the monetary prices and the time it will take to function a plan. These outcomes recommend that higher consciousness of the particular prices in addition to plan choices designed for small corporations might assist scale back the obstacles that small corporations understand.

Lastly, the expansion of state-sponsored retirement packages may very well encourage corporations with no plan to undertake one.

References

Bloomfield, Adam, Kyung Min Lee, Jay Philbrick, and Sita Slavov. 2023. “How Do Companies Reply to State Retirement Plan Mandates.” Working Paper 31398. Cambridge, MA: Nationwide Bureau of Financial Analysis.

Middle for Retirement Analysis at Boston School, Worker Profit Analysis Institute, and Greenwald Analysis. 2023. 2023 Small Employer Retirement Survey.

Chen, Anqi. 2023. “Small Enterprise Retirement Plans: The Significance of Employer Perceptions of Advantages and Prices.” Particular Report. Chestnut Hill, MA: Middle for Retirement Analysis at Boston School.

Drobleyn, Eric. 2023. “How A lot Time Does Annual 401(ok) Administration Take?” Cellular, AL: Worker Fiduciary.

Guzoto, Theron, Mark Hines, and Allison Shelton. 2022. “State Auto-IRAs Proceed to Complement Personal Marketplace for Retirement Plans.” Washington, DC: Pew Charitable Trusts.

U.S. Bureau of Labor Statistics. Enterprise Employment Dynamics, 2022. Washington, DC.

U.S. Bureau of Labor Statistics. Nationwide Compensation Survey, 2021. Washington, DC.

Yakoboski, Paul and Pamela Ostuw. 1998. “Small Employers and the Problem of Sponsoring a Retirement Plan: Outcomes of the 1998 Small Employer Retirement Survey.” Difficulty Temporary Quantity 202. Washington, DC: Worker Profit Analysis Institute.

[ad_2]