[ad_1]

In case you’re like many enterprise house owners, you realize that it’s a must to deal with sure duties, like buying objects, taking up debt, or placing your individual cash into your enterprise, to get your enterprise up and operating. And when your organization processes any kind of transaction, whether or not it’s debt, purchases, and so on., it’s a must to file it in your books. That is the place accounting belongings vs. liabilities come into play. To get a strong understanding of the distinction between belongings vs. liabilities, hold studying.

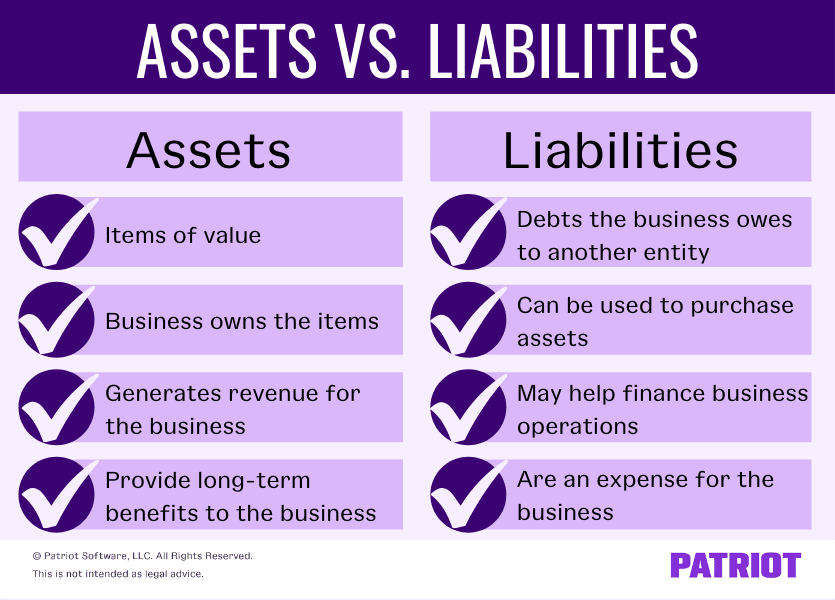

Belongings vs. liabilities: The variations

What’s the distinction between belongings vs. liabilities? To know how the 2 differ, it’s a must to know the legal responsibility vs. asset that means:

- Liabilities: Current money owed a enterprise owes to a different enterprise, vendor, worker, group, lender, or authorities company. Liabilities might help house owners finance their corporations (e.g., loans).

- Belongings: Objects or assets of worth that the enterprise owns. Belongings can generate income and supply long-term advantages to the proprietor (e.g., property).

Each belongings and liabilities are on the stability sheet, which is likely one of the three foremost monetary statements for companies.

Examples of liabilities

Liabilities may be short- or long-term. Usually, short-term liabilities are generally known as present liabilities. And, long-term liabilities are known as noncurrent liabilities.

Examples of present liabilities embody:

- Brief-term money owed (e.g., bank card balances)

- Tax liabilities (e.g., payroll taxes)

- Accrued bills (e.g., acquired items you bought however haven’t acquired an bill but)

- Accounts payable (i.e., unpaid invoices)

Listed here are a couple of examples of noncurrent liabilities:

- Loans lasting greater than a yr (e.g., mortgage loans)

- Deferred tax funds

- Different noncurrent liabilities (e.g., leases)

You need to pay short-term liabilities inside one yr of incurring the debt. Lengthy-term liabilities embody money owed you pay over a interval that’s longer than a yr.

Examples of belongings

Like liabilities, companies can have present and stuck belongings (aka noncurrent belongings). A present asset is a short-term asset, whereas noncurrent belongings are long-term.

Examples of present belongings embody:

Present belongings may be transformed into money shortly, usually below one yr. One other frequent time period for present belongings is short-term investments.

Examples of noncurrent belongings embody:

- Property (e.g., buildings or automobiles)

- Gear

- Patents or emblems

Noncurrent belongings are also referred to as fastened belongings. They supply long-term, continuous worth to a enterprise. However, companies can’t convert fastened belongings into money inside one yr. Lengthy-term belongings usually depreciate in worth over time (e.g., firm automobiles).

Belongings may also be tangible or intangible. Tangible belongings are bodily objects that the enterprise owns. A lot of these belongings simply convert to money. Bodily belongings embody objects equivalent to stock, gear, and bonds.

Intangible belongings are nonphysical objects that don’t simply convert to money. Examples of intangible belongings embody logos, emblems, patents, and enterprise licenses.

Belongings and liabilities examples

There’s some overlap between belongings and liabilities as a result of you need to use a legal responsibility to buy an asset. To completely perceive the distinction between belongings and liabilities, check out some asset vs. legal responsibility examples.

Instance 1

Your corporation grows and also you weigh the professionals and cons of leasing vs. shopping for industrial property. After inspecting your books, you determine to buy property.

The property you buy is a long-term asset you could develop in worth through the years you personal it. The price of the property is unfold out over time as a substitute of 1 yr.

Alternatively, the mortgage for the property is a legal responsibility in your books. The mortgage mortgage is a long-term debt you owe to a lender.

Instance 2

Say you determine to lease a automotive on your staff to make use of on official enterprise. Is the automotive an asset? No. The automotive just isn’t your property as a result of it isn’t a purchase order.

As an alternative, a leased automobile is a legal responsibility for the enterprise regardless that the enterprise has momentary possession of the automotive. Funds for the lease improve bills for the enterprise however don’t present an merchandise of worth to the enterprise’s bookkeeping.

Instance 3

Let’s say you determine to buy the leased automobile when the lease time period is up. You could take out an auto mortgage to finance the acquisition of the automotive.

While you buy the automobile, it turns into an asset you file in your stability sheet. And, the auto mortgage is a brand new legal responsibility you file, too.

Why is the auto mortgage a brand new legal responsibility? When the lease time period is finished, the legal responsibility is full since you paid everything of the lease. Signing an auto mortgage creates a brand new debt for the enterprise.

Instance 4

Say you select to make use of funds from your enterprise to buy the leased automobile on the finish of the lease time period. By utilizing your enterprise funds, you would not have to take out an auto mortgage.

The automobile turns into an asset on the time of buy. As a result of there is no such thing as a mortgage, you don’t incur a legal responsibility. As an alternative, the acquisition is an expense.

Belongings vs. liabilities vs. fairness

Now that you realize the distinction between belongings vs. liabilities, it’s time to know the function of fairness within the accounting equation. Fairness is the:

- Quantity the enterprise proprietor or stockholders put money into the corporate

- Worth of the corporate

Fairness is an important a part of the enterprise’s relationship between belongings and liabilities.

On a stability sheet, belongings equal the entire liabilities plus the entire fairness. In the event that they don’t stability, you should discover and repair the discrepancy. There are a number of methods to take a look at the equation:

Fairness = Belongings – Liabilities

Belongings = Liabilities + Fairness

Liabilities = Belongings – Fairness

The accounting equation reveals enterprise house owners and their monetary advisors if the enterprise makes use of its personal funds or funds via debt. Solely corporations that use double-entry bookkeeping ought to use the accounting equation.

Fairness has an equal impact on either side of the equation. If a enterprise has solely two elements to the equation (e.g., fairness and belongings), it will possibly calculate the third quantity with ease.

This text has been up to date from its authentic publication date of March 22, 2022.

This isn’t supposed as authorized recommendation; for extra data, please click on right here.

[ad_2]