[ad_1]

The temporary’s key findings are:

- IBM has reopened its outlined profit plan to make use of the plan’s surplus – fairly than company money – to fund retirement contributions.

- This shift has been fueled by a extra favorable regulatory setting and the improved funded standing of outlined profit plans.

- Whereas utilizing “trapped surpluses” helps the agency, employees might properly come out behind until the positive aspects are shared.

- Apparently, the evaluation finds that solely a handful of different giant corporations are probably candidates to observe IBM’s lead.

- Thus, the transfer ought to be seen as a monetary maneuver, not a significant change within the provision of retirement earnings.

Introduction

Enthusiasm appears to be rising to reopen – or no less than to cease closing and freezing – outlined profit retirement plans. The impetus comes from a extra benign regulatory setting and the improved funded standing of those plans, even earlier than the current rise in rates of interest. Reopening plans permits employers to make use of surplus property, which if reverted to the sponsor could be topic to a 50-percent excise tax along with the employer earnings tax. Probably the most dramatic manifestation of this enthusiasm for reopening plans has been IBM’s announcement to shift its 401(ok) match to an computerized contribution to the money stability element of its beforehand frozen outlined profit plan.

This temporary lays out the implications of IBM’s shift for the corporate and its staff, and speculates about which corporations may observe IBM’s lead. Particularly, the dialogue proceeds as follows. The primary part describes the altering regulatory setting and monetary standing of single-employer outlined profit plans. The second part gives the main points of IBM’s startling transfer and its implications for each employers and staff. The third part identifies giant overfunded plans that might observe IBM’s lead.

The ultimate part concludes with two factors. First, plan sponsors clearly acquire by placing the “trapped” surpluses to make use of, however, with out some sharing of the positive aspects, staff might properly come out behind. Second, amongst main corporations, solely a handful are probably candidates to reopen their outlined profit plans. The nation’s largest banks lead the listing: Financial institution of America and JPMorgan Chase are notably properly positioned, however Citigroup can be a risk. Two non-financial companies – Honeywell Worldwide and Deere & Co. – are additionally potential candidates.

Regulatory and Monetary Developments

The shift from outlined profit pensions to 401(ok) plans has been underway since 1981, however throughout the Eighties and Nineties this pattern mirrored a surge in 401(ok)s – not the closing of outlined profit plans. Actually, the Nineties had been a good time to sponsor an outlined profit plan. Rising asset values allowed sponsors to make little or no money contributions to their pension funds. By the flip of the century, pension property amounted to 123 % of liabilities (see Determine 1).

The scene modified dramatically in 2000 when the tech bubble burst and rates of interest tumbled, highlighting the mismatch between property and liabilities. In response, Congress tightened funding guidelines within the 2006 Pension Safety Act. For single-employer pension plans, it first set the interval for amortizing all unfunded liabilities at 7 years. Second, it specified three rates of interest for use for discounting promised advantages. The charges, known as section charges, depend upon when the advantages are anticipated to be paid – in lower than 5 years, 5-20 years, and greater than 20 years. The section charges are company bond yields averaged over the previous 24 months.

On the similar time that Congress tightened funding requirements, the Monetary Accounting Requirements Board modified the reporting necessities, forcing companies to deal with internet pension liabilities as debt on their stability sheet.

Shortly after the tightening of funding necessities and the adoption of stricter accounting guidelines, the inventory market and the financial system collapsed within the International Monetary Disaster (2007-2009). With the brand new provisions, the drop in funded standing imposed actual prices on sponsoring companies – their earnings and stability sheets took a success, and so they confronted a pointy improve in required pension contributions.

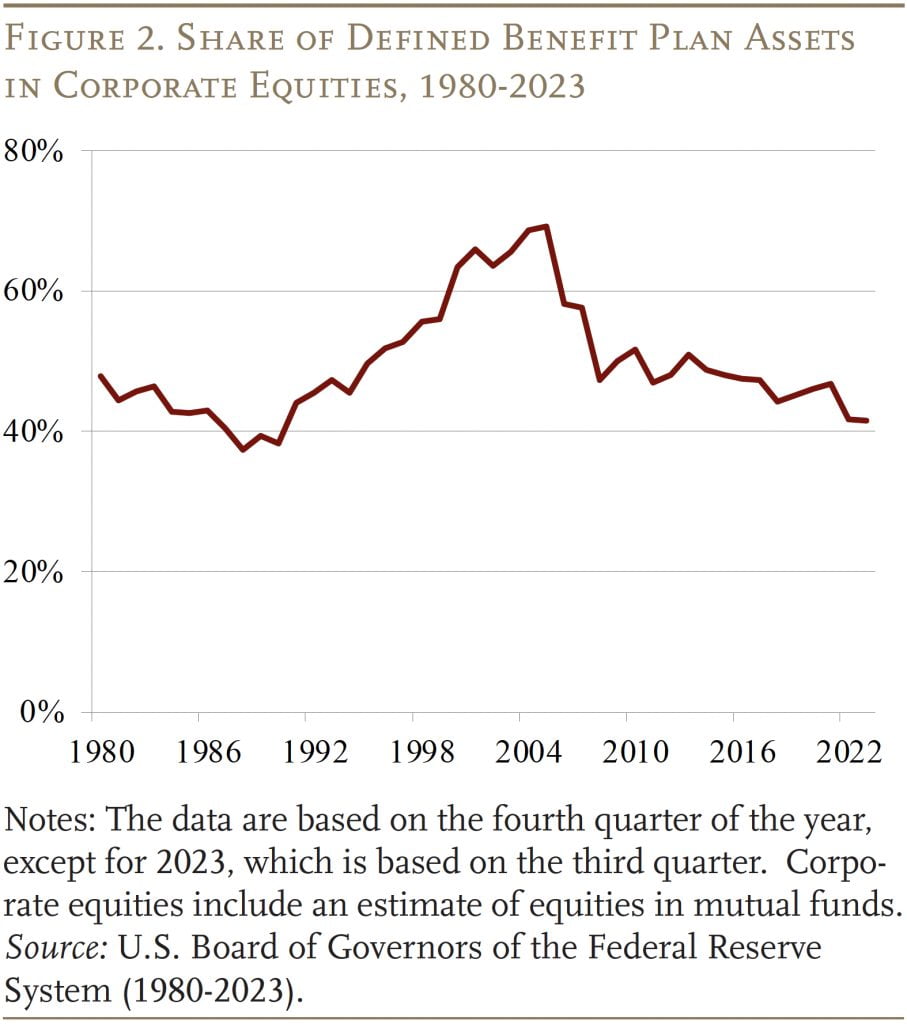

In response, company sponsors did two issues. First, they modified their plans’ asset combine, which included shifting away from equities (see Determine 2) and buying bonds that matured as profit liabilities had been projected to fall due (liability-driven funding). On the similar time, they started closing and freezing their outlined profit plans in favor of 401(ok)s. Many outlined profit plan sponsors put themselves on a path to ultimately get out of the enterprise altogether.

Within the wake of the International Monetary Disaster, two developments made single-employer outlined profit plans extra enticing. First, their funds improved. The change in asset allocation made them a lot much less weak to market swings, and a rising inventory market led to increased asset values. On the similar time, the closing and/or freezing of plans slowed the expansion in liabilities. Consequently, the ratio of property to liabilities elevated from a low of 77 % in 2012 to 96 % in 2021. After all, the spike in rates of interest in 2022 – regardless of poor market returns – boosted funding ranges even additional.

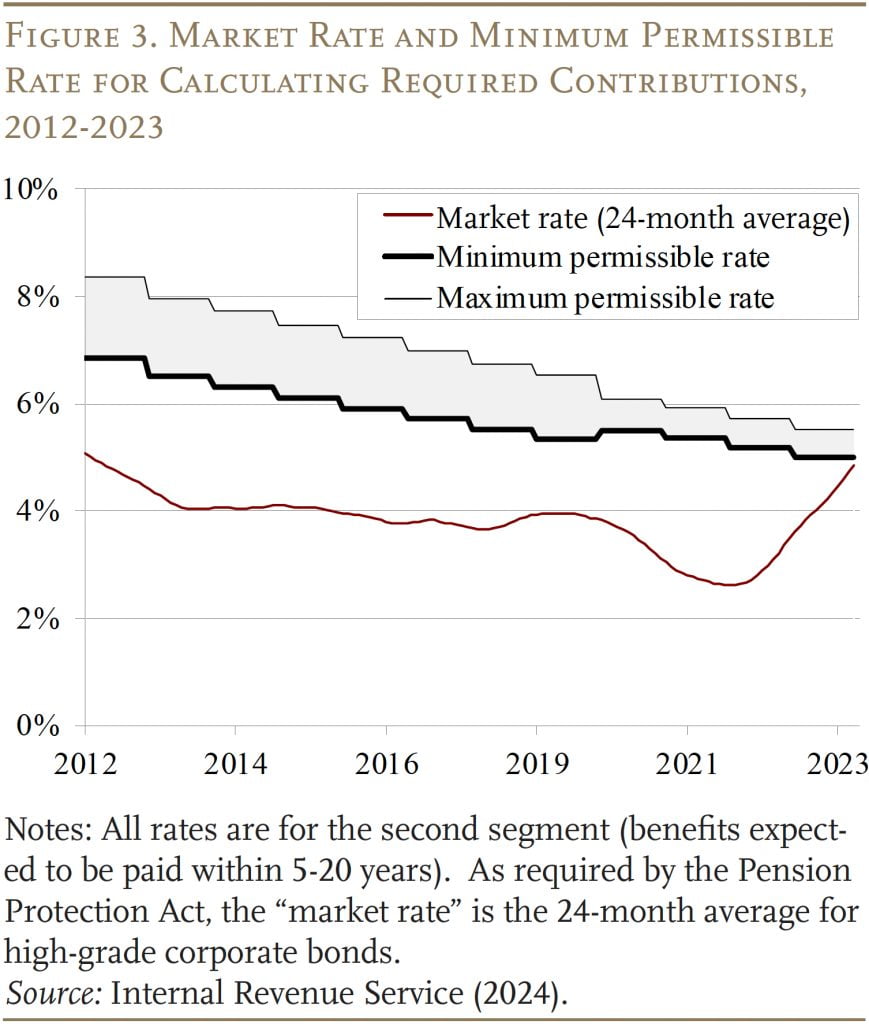

Second, Congress supplied funding reduction. The primary essential piece of laws was the 2012 Shifting Forward for Progress within the twenty first Century Act, which permitted the market price established by the 2006 Pension Safety Act to be averaged over the prior 25 years – a interval when charges had been considerably increased. It additionally established a hall that set the minimal and most charges at 90 % and 110 % of the common, respectively.

The 2012 laws envisioned the hall widening over time, which – with market charges considerably under the hall – would have decreased the low cost price and elevated liabilities and minimal required contributions. However extra iterations of funding reduction prevented this widening from occurring. Consequently, the speed used to calculate liabilities for funding functions has been about 200 foundation factors increased than the “market price” specified within the Pension Safety Act (see Determine 3).

For single-employer outlined profit plans, the second and most dramatic items of funding reduction had been included within the American Rescue Plan Act of 2021. First, it set a ground of 5 % on the 25-year common and narrowed the hall across the common to the vary of 95 % to 105 %. This transformation comes simply because the 25-year common was shifting away from traditionally excessive charges, which might have eradicated the hole between the minimal permissible price and the “market price.” The laws additionally completely elevated the amortization interval from 7 years to fifteen years, which will increase the time for underfunded plans to achieve full funding.

A collection of three influential articles from JPMorgan Asset Administration argue that the improved monetary situation of outlined profit plans – higher funded and fewer dangerous – and the funding reduction have “severed the hyperlink” between actions in market rates of interest and required pension contributions. For the reason that concern of huge required contributions was a significant component that drove employers away from outlined profit plans, the elimination of contribution danger ought to lead sponsors to rethink potential methods to make use of the “trapped property” of their outlined profit plans. It looks like IBM was listening to this recommendation.

What IBM Did and Why

Beginning in January 2024, IBM ended its 5-percent matching contribution and 1-percent computerized contribution to staff’ 401(ok) accounts in favor of an computerized 5-percent contribution to a “Retirement Profit Account” for every worker. The Retirement Profit Account is the worker’s “notional” account within the money stability element of the corporate’s outlined profit plan. IBM had closed its outlined profit plan to new individuals in 2005 and “frozen” advantages – that’s, ended new accruals – for current individuals in 2008.

Money stability plans are outlined profit plans that retain notional particular person accounts till the account is paid out to the person. Like conventional outlined profit plans, the employer makes the contributions and bears the funding danger, whereas the plan fiduciaries handle the investments. As well as, the plan credit the worker’s account with notional earnings, often as curiosity based mostly on the present yield on pre-selected Treasury securities. Workers obtain common statements and usually can withdraw the stability as a lump sum after they retire or terminate employment. In contrast to 401(ok) plans, nonetheless, money stability plans are required to supply staff the flexibility to obtain their advantages within the type of an annuity for the worker’s life or for the lifetimes of the worker and the worker’s surviving partner.

Traditionally, IBM had robotically enrolled new staff in its 401(ok) plan at 5 % of wage after 30 days, until the worker opted out. After one 12 months, staff then grew to become eligible for IBM’s 5-percent matching contribution and 1-percent computerized employer contribution. Below the brand new association, staff obtain a month-to-month credit score of 5 % of pay into their Retirement Profit Account, with the choice to avoid wasting extra quantities by way of the corporate’s conventional or Roth 401(ok) plans. To compensate for the lack of the corporate’s earlier 1-percent computerized employer contribution, IBM elevated salaries by 1 % efficient January 1, 2024.

The assured price of notional earnings for IBM’s new Retirement Profit Accounts are as follows:

- first 3 years: 6 % curiosity;

- 2027-2033: yield on 10-year Treasury, with a ground of three %; and

- 2034 and past: yield on 10-year Treasury.

What Does This Shift Imply for the Firm?

Probably the most vital good thing about the shift is that it permits IBM to fund retirement contributions with the excess in its overfunded outlined profit plan fairly than with company money contributed to its 401(ok) plan. In response to its annual report, IBM held a surplus of $5 billion in its outlined profit plan, whereas it paid out $530 million yearly in matching and computerized 1-percent contributions to the 401(ok). Confronted with no funding necessities for its over-funded outlined profit plan, IBM can use the $5 billion surplus within the plan to pay for the 5-percent month-to-month credit supplied to staff’ notional particular person accounts for no less than the subsequent 10 years – enhancing its money stream assertion by about $500 million annually. Finally, IBM should make a contribution to the plan out of firm cash, however good funding efficiency might assist scale back the annual burden.

The drawbacks are modest in comparison with the acquire. First, common actuarial analyses and annual premiums to the Pension Profit Warranty Company make outlined profit plans dearer to function than 401(ok)s. Second, the IBM plan should present the curiosity credit to individuals’ notional accounts, which, as famous, will quantity to six % within the quick run. These funds should not essentially linked to the funding efficiency of the property, which would require some hedging effort on the a part of IBM. Third, the discount within the plan’s surplus to fund the month-to-month pay credit will present up as a adverse adjustment within the firm’s monetary statements. Finally, IBM should make some funding contributions, however the fee schedule shall be rather more versatile than the annual contributions to the 401(ok) plan. Alternatively, at that time, the corporate might simply re-freeze the DB plan and revert to the sooner sample of constructing money contributions to the 401(ok) plan. In both case, the corporate clearly comes out forward.

What Does This Shift Imply for Workers?

Whereas IBM clearly positive aspects from this maneuver, its staff might properly lose. On the constructive aspect, staff not collaborating within the present 401(ok) or not maxing out the employer match will certainly acquire, however the positive aspects right here could be very small since 97 % of employees at IBM take part within the 401(ok). Equally, the flexibility to obtain lifetime advantages – supplied at very low price – might alleviate among the challenges related to withdrawing 401(ok) balances and buying an annuity. However the positive aspects right here depend upon what number of individuals go for the lifetime profit versus the lump sum, and in addition – as within the case of an annuity bought with 401(ok) {dollars} – the worth of lifetime earnings relies upon crucially on what occurs on the inflation entrance. In brief, the potential positive aspects for workers are modest.

In distinction, the potential losses for workers are significant. First, if staff don’t modify the asset composition of their 401(ok) contributions, they may have an excessive amount of of their property in fixed-income investments. After the upper preliminary assure, IBM will present credit equal to the yield on Treasuries. If the corporate’s 5-percent contribution had gone into the 401(ok) as a substitute, it could earn the return on a mixture of shares and bonds – presumably increased. As well as, with out a match, staff might properly reduce on their 401(ok) saving and find yourself placing much less apart for retirement. On stability, staff are more likely to come out behind.

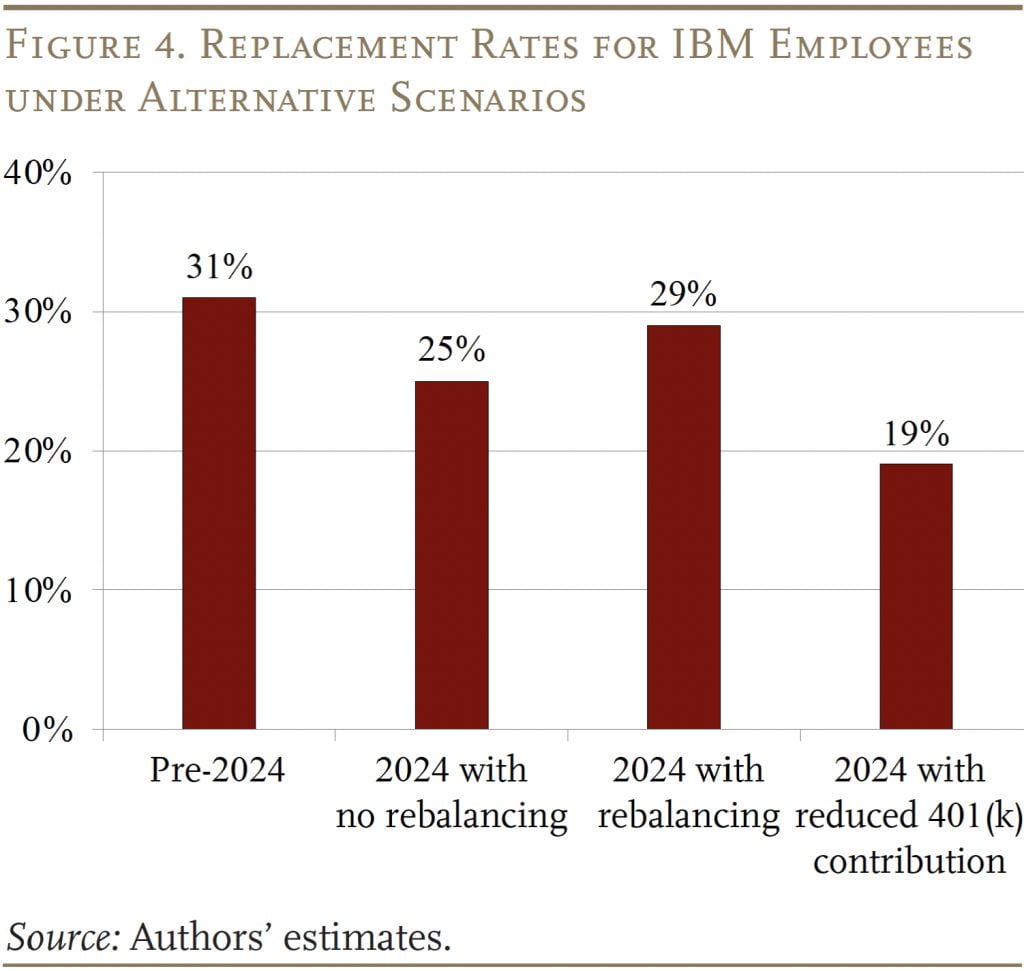

A easy simulation can present some sense of how the worker’s behavioral response can have an effect on the result. The evaluation focuses on a brand new worker who’s age 30 in 2024 and retires at 65. With out IBM’s swap, this worker contributing 5 % to the 401(ok) plan and receiving the 5-percent matching contribution – assuming a portfolio of 60-percent equities and 40-percent bonds – would have a alternative price of 31 % from the IBM plan at retirement. If the worker now saves 5 % within the 401(ok) invested 60/40 in equities and bonds and 5 % in a money stability plan with IBM’s design (the 10-year Treasury apart from assured returns within the early years), the alternative price drops to 25 %. If the worker rebalances and places all his 401(ok) property in equities, the alternative price recovers, however not all the best way again as a result of the ratio throughout each plans is 50/50 not 60/40. Lastly, the worker can resolve to avoid wasting much less within the absence of an employer match. If the worker cuts the 401(ok) contribution to three %, and doesn’t rebalance, the alternative price drops to 19 %. The necessary level is that every one the potential outcomes for the worker are decrease than below IBM’s earlier association (see Determine 4).

Will Others Comply with?

Will different company sponsors observe swimsuit and reopen their outlined profit plan? As mentioned, IBM’s acquire comes from utilizing the excess in its overfunded outlined profit plan to enhance its money stream by lowering its ongoing retirement contribution prices. Accordingly, a possible follower ought to have: 1) a big outlined profit surplus that may be put to make use of; and a pair of) giant 401(ok) contributions that, as soon as saved or decreased, can considerably enhance the corporate’s money stream. As well as, an current money stability element within the present closed/frozen plan might make the transition simpler, and a plan that covers non-unionized staff would keep away from the necessity for negotiations.

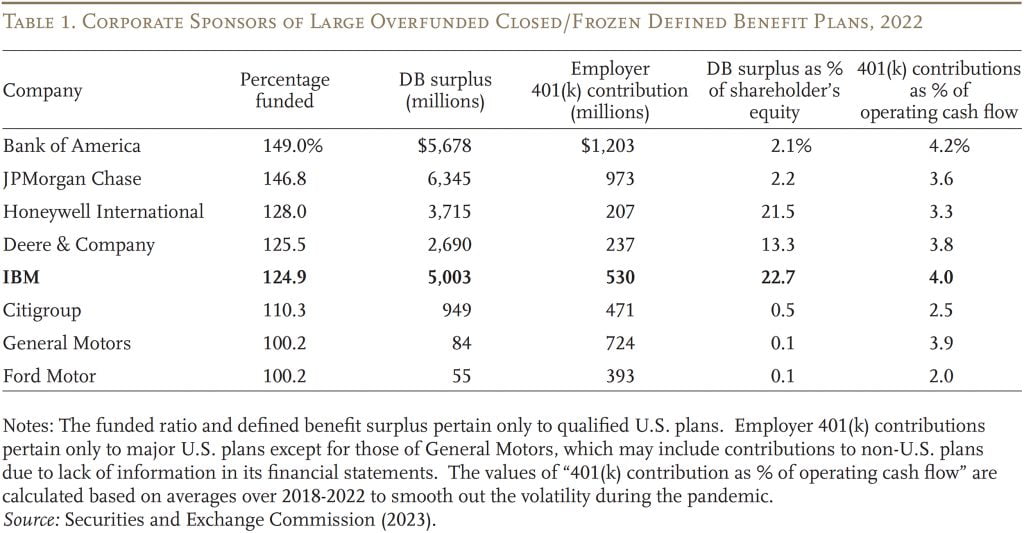

The evaluation began by wanting on the 45 U.S. corporations with outlined profit obligations of greater than $10 billion. Narrowing the main target to closed/frozen plans with a funded ratio over 100% resulted in eight corporations. These corporations, ordered by their funded ratios, are proven in Desk 1. The desk additionally consists of the excess within the firm’s outlined profit plan, contributions to the corporate’s 401(ok) plan, and two measures which may present an incentive to think about IBM’s strategy – the outlined profit surplus relative to shareholders’ fairness and 401(ok) contributions’ relative to annual money stream. Not surprisingly, IBM ranks excessive on each incentive measures. All corporations besides Ford have a significant money stability element of their plans.

On the highest of the listing are the nation’s two largest banks – Financial institution of America and JPMorgan Chase. The sheer greenback quantity of their pension surpluses might set off severe consideration of potential different makes use of. Additionally, these corporations made giant 401(ok) contributions each in greenback quantity ($1.2 billion and $1 billion, respectively) and as a share of their annual money stream (4.2 % and three.6 %, respectively). These numbers indicate that the potential positive aspects from reopening their outlined profit plans may very well be even higher than IBM’s. Citigroup, the fourth largest U.S. financial institution, can be on the listing with a funded ratio of 110 %, though its outlined profit surplus and 401(ok) contributions are a lot decrease than the highest two. As few monetary sector staff are unionized, these banks would have nice discretion in setting plan provisions in the event that they determined to reopen the money stability element of their outlined profit plans.

Honeywell Worldwide and Deere & Co., that are third and fourth on the listing, face a scenario much like IBM’s when it comes to the relative sizes of their surpluses and 401(ok) prices. Deere & Co. might not take additional actions anytime quickly because it simply closed its outlined profit plan for salaried staff to new hires in January 2023 and significantly enhanced its 401(ok) matching price. Nonetheless, down the street, a speedy improve in 401(ok) prices might set off a reconsideration of the outlined profit choice.

Common Motors and Ford appear unlikely to observe IBM in reopening their barely absolutely funded outlined profit plans. Restoring their outlined profit plans was truly on the listing of calls for of the United Auto Employees throughout the strike in 2023, and the automakers rejected it. As an alternative, the auto corporations agreed to extend their 401(ok) contributions from 6.4 % to 10 % of pay with no required worker contributions. Though Common Motors and Ford are more likely to see elevated 401(ok) contributions in coming years, they only don’t have the outlined profit surplus wanted to undertake IBM’s strategy.

General, the massive banks – Financial institution of America, JPMorgan Chase, and perhaps Citigroup – and two nonfinancial corporations – Honeywell Worldwide and Deere & Co – are the almost certainly candidates to reopen their outlined profit plans.

Conclusion

IBM’s shift to reopen its outlined profit plan for retirement advantages is a big improvement on the planet of pensions. It’s a monetary maneuver, nonetheless, that permits IBM to fund retirement contributions with the excess in its overfunded outlined profit plan fairly than company money; it’s not a significant change in how the non-public sector gives retirement earnings. The transfer has been fueled by a extra favorable regulatory setting and the improved funded standing of those plans. Whereas tapping “trapped “surpluses” advantages the corporate, staff face much less flexibility of their funding choices and certain decrease alternative charges. Solely a handful of different giant corporations are positioned to observe IBM’s lead. The nation’s largest banks head the listing: Financial institution of America and JPMorgan Chase are notably properly positioned, however Citigroup can be a risk. Two non-financial companies – Honeywell Worldwide and Deere & Co. – are additionally potential candidates.

References

Congressional Finances Workplace. 2023. The 2023 Lengthy-Time period Finances Outlook. Washington, DC.

Gross, Jared and Mike Buchenholz. 2023. “Pension Defrost: Is It Time to Reopen DB Pension Plans—or at Least Cease Closing and Freezing Them?” Report. New York, NY: JPMorgan Asset Administration.

Gross, Jared and Michael Buchenholz. 2022. “The Roadmap to Pension Stability.” Report. New York, NY: JPMorgan Asset Administration.

Gross, Jared and Michael Buchenholz. 2021. “Rethinking the Pension Plan Endgame: Hibernation, Termination or Stabilization?” Report. New York, NY: JPMorgan Asset Administration.

IBM. 2023. “IBM Advantages 2024 IBM U.S. Advantages Information.” Armonk, NY.

Inside Income Service. 2024. “Pension Plan Funding Segments.” Washington, DC.

JPMorgan Asset Administration. 2024. “2024 Lengthy-Time period Capital Market Assumptions.” twenty eighth Annual Version. New York, NY.

Munnell, Alicia H., Mauricio Soto, J.P. Aubry and Christopher J. Baum. 2007. “Why Are Corporations Freezing Their Pensions?” Working Paper 2007-22. Chestnut Hill, MA: Heart for Retirement Analysis at Boston School.

Securities and Trade Fee. 2023. Monetary Statements filed by numerous corporations. Washington, DC.

U.S. Board of Governors of the Federal Reserve System. Monetary Accounts of america, 1980-2023. Washington, DC.

[ad_2]