[ad_1]

Development payroll is advanced, however the fitting software program may also help. I examine 6 prime development payroll software program that will help you discover the perfect.

Managing payroll within the development {industry} is daunting because of the sector’s numerous workforce, fluctuating work hours, and laws.

Challenges can result in inaccuracies in payroll processing, elevated administrative burden, and authorized points.

On this article, I examine the 6 finest payroll software program for development firms to streamline payroll, improve accuracy, and guarantee compliance.

Should you don’t have the time to learn by means of our analysis, bounce all the way down to our fast comparability desk.

Our Prime Picks

-

Finest all-in-one development payroll software program

-

-

Good for tax submitting and tax credit

How I Selected the Finest Payroll Software program for Development Corporations

I appeared for some key options when selecting the highest development payroll software program.

Should-have options:

- Time monitoring: Precisely captures worker hours throughout tasks, jobs, and duties, ideally incorporating GPS monitoring for exact location-based time recording.

- Job costing and reporting: Supplies detailed studies on labor prices by challenge, permitting for efficient funds and challenge value administration.

- Advantages administration: Allows administration of worker advantages, resembling medical health insurance and retirement plans.

- Tax and compliance reporting: Generates exact federal, state, and native tax studies, together with required compliance studies.

I additionally made certain the software program has:

- Person-friendly interface to make sure straightforward use and adoption for workers with various technical expertise.

- Inexpensive pricing that aligns together with your funds with out compromising crucial functionalities.

Lastly, I checked for options that make development payroll software program nice:

- Multi-state payroll course ofing: Helps operations throughout varied states with their very own labor and tax laws.

- Tax submitting: Automates the calculation, withholding, and reporting of payroll taxes, minimizing the danger of errors and penalties.

- Capability to deal with a number of worker sorts: Helps compliant payroll for full-time, part-time, contract, and unionized development staff.

- Worker self-service portals: Lets staff view their pay stubs, tax types, and advantages.

- Superior reporting and analytics: Lets you monitor traits, optimize labor allocation, and establish cost-saving alternatives.

The 6 Finest Development Firm Payroll Software program of 2024

-

Connecteam — Finest all-in-one development payroll software program

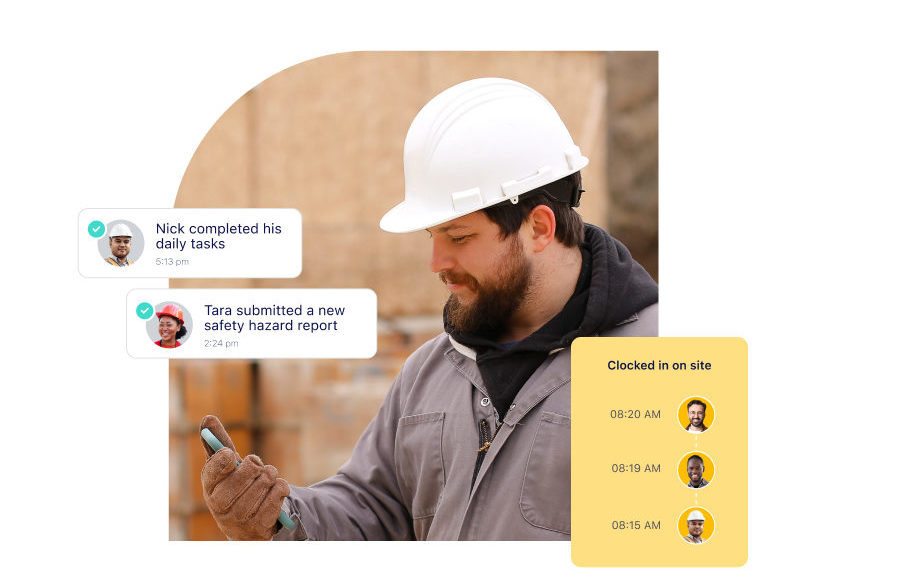

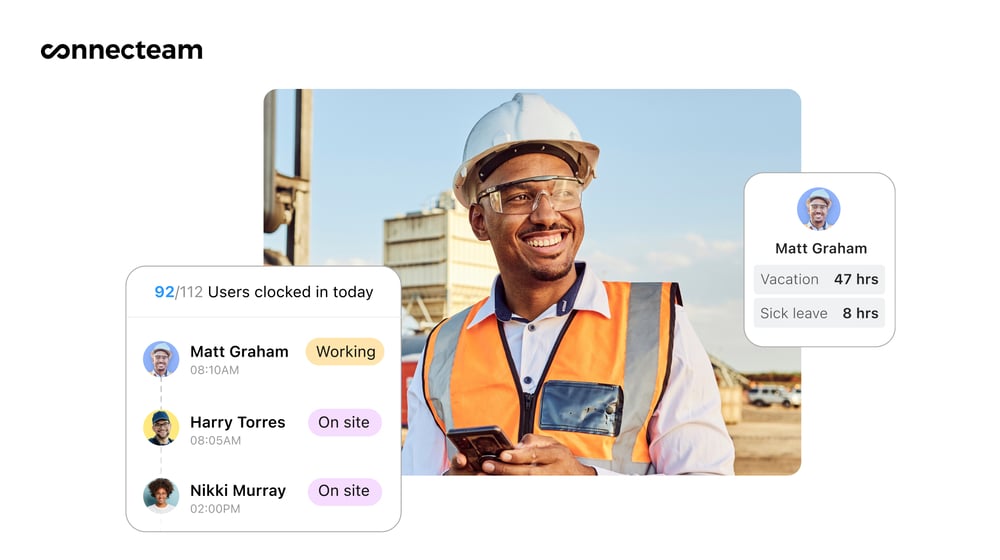

Connecteam is a cloud-based platform providing a complete set of options that streamline timekeeping and assist you handle payroll whereas guaranteeing compliance with laws.

Why I selected Connecteam: Connecteam tops my listing of finest development payroll software program due to its superior time-tracking options, user-friendly interface, and seamless payroll integrations with main suppliers.

Let’s take a look at these options beneath.

Automated timesheets

Connecteam makes payroll straightforward to your development enterprise. Connecteam’s worker time clock tracks all worker hours and creates automated timesheets. These are then prepared to your evaluation, approval, and payroll. I admire that for those who spot any errors, you possibly can repair them shortly and simply.

Superior time-tracking options

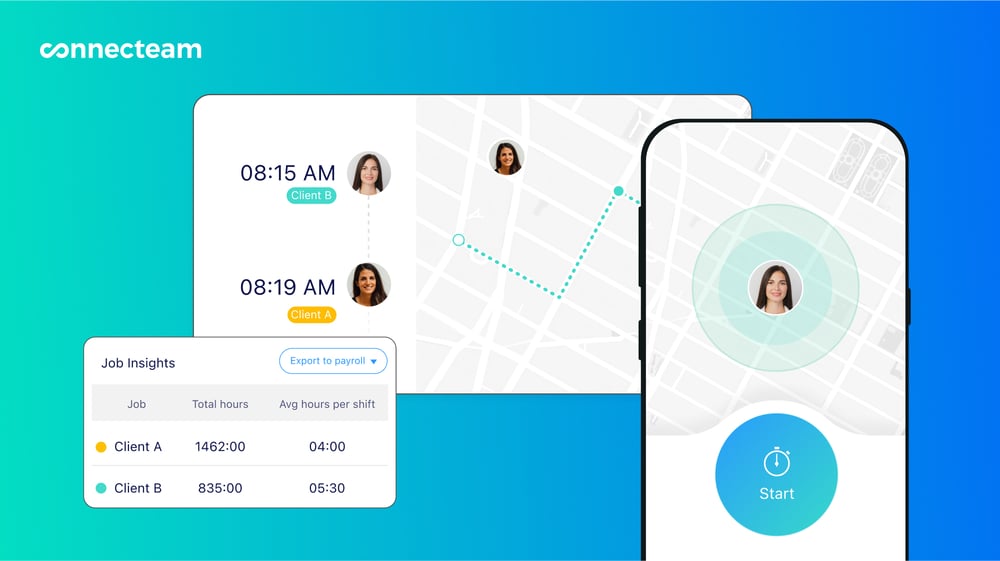

Connecteam’s time clock makes use of a real-time GPS tracker that will help you hold your payroll spot-on. When your staff clock in or out from their cell units, Connecteam information their GPS areas so you possibly can guarantee they’re precisely the place they need to be.

Moreover, Connecteam’s geofence time clock places a digital fence round your work websites, enabling you to permit clock-ins and clock-outs solely when staff are on web site. Plus, with breadcrumbs, you possibly can see your group’s path between websites, serving to you catch any unplanned detours and hold payroll exact.

Furthermore, Connecteam will be deployed as a kiosk app, enabling staff to make use of a shared system for clocking out and in with their distinctive PIN codes.

With these instruments and extra, you possibly can remove time theft—staff claiming hours they haven’t truly labored—guaranteeing you’re answerable for correct time monitoring and payroll.

Superior additional time, break, and time-off monitoring

Connecteam’s overtime monitoring mechanically information and calculates pay for workers’ additional time hours, making managing and paying for additional time simpler. It permits you to arrange customized additional time charges, like time-and-a-half or double-time, primarily based by yourself guidelines or native legal guidelines.

The break administration app ensures straightforward and correct monitoring and calculating of paid and unpaid breaks. You’ll be able to go for staff to manually clock out and in for breaks or have the system mechanically calculate break deductions.

Plus, the time without work administration app ensures unpaid time without work and paid time without work (PTO) is precisely tracked and mirrored in your payroll, aligning together with your firm’s PTO insurance policies and native legal guidelines.

I like how straightforward Connecteam makes it to maintain your payroll correct and in keeping with labor legal guidelines.

Versatile payroll configurations

You’ll be able to configure your account to assign every hour to a chosen challenge or shopper, a crucial characteristic for job costing and funds administration.

You’ll be able to even set completely different pay charges for various jobs or staff—from full-time staff to contractors—and Connecteam does the maths on hours, breaks, and additional time for you.

The worker self-service characteristic lets staff examine their timesheets and request adjustments, and you’ll approve them immediately earlier than payroll course ofing.

Seamless payroll integrations

For seamless payroll execution, Connecteam integrates with prime payroll suppliers resembling Gusto, QuickBooks, Paychex, and Xero, guaranteeing easy information switch. On the finish of every payroll interval, it mechanically exports timesheets for payroll, together with detailed work hours and breaks, with choices to customise information fields and set automated export schedules. This facilitates a exact and environment friendly payroll course of.

Extra options for streamlining development operations

Connecteam additionally provides a complete development administration toolkit extending past payroll to streamline your operations. Its options embrace worker scheduling, activity administration, digital checklists, communication options, and extra.

Connecteam additionally provides a free for all times plan – Strive Connecteam right here!

Key Options

-

Automated timesheets

-

Time clock

-

GPS time monitoring and geofencing

-

Time beyond regulation, break, and time without work monitoring

-

Payroll integrations (Gusto, QuickBooks, Paychex, Xero)

-

Automated timesheet export

Pricing

Free-for-life plan accessiblePremium plans begin at $29/month for 30 customers

-

-

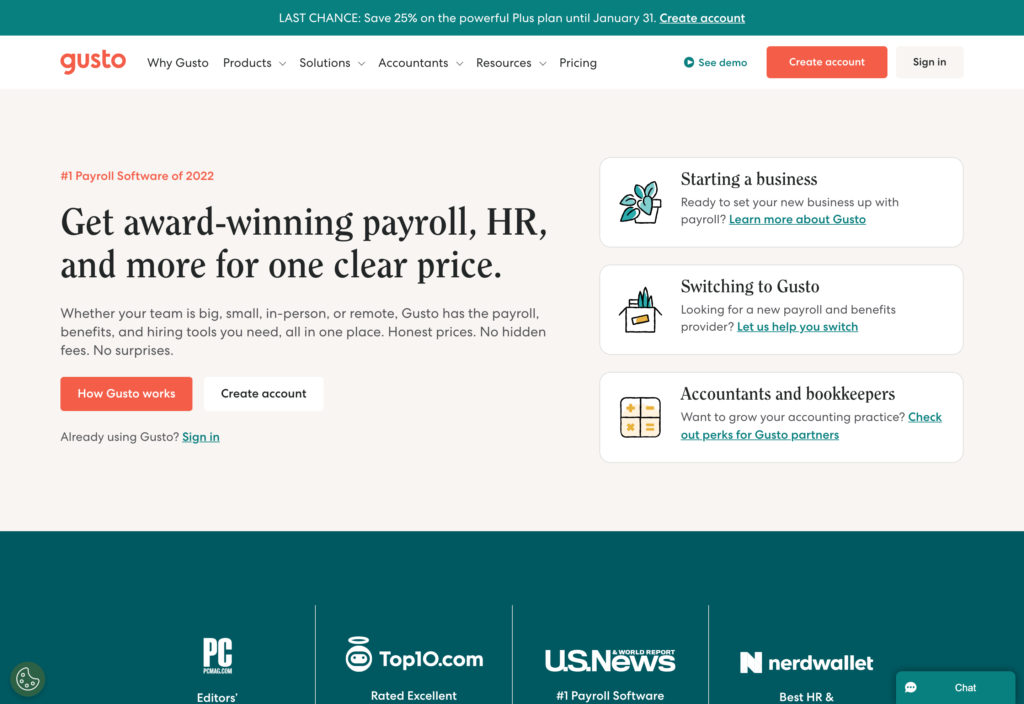

Gusto — Good for contractors

Gusto is a cloud-based platform providing a set of instruments for payroll, advantages, and human useful resource administration, tailor-made to fulfill the wants of small and medium-sized companies.

Why I Selected Gusto: Gusto is without doubt one of the finest payroll software program for small development firms, offering tailor-made options that sort out the sector-specific challenges of managing a fluctuating workforce.

Tax compliance throughout states

A characteristic I discovered notably useful is Gusto’s automated tax processing and filings. This performance is a lifesaver for development firms that function throughout a number of states. It ensures compliance with the various tax legal guidelines and laws in several jurisdictions.

Time monitoring and integration

One other standout characteristic is the time monitoring integrations. These can help you import hours labored from varied time-tracking platforms—together with Connecteam—immediately into the payroll system.

Gusto’s time clock kiosk app transforms any related system right into a centralized station for clocking out and in, geared up with PIN-operated sign-in to remove time theft.

Employees’ compensation and compliance

Gusto gives staff’ compensation administration, a crucial side on this high-risk {industry}. The platform simplifies acquiring and managing staff’ compensation insurance coverage, guaranteeing that firms adjust to laws.

One other useful characteristic Gusto provides is licensed payroll studies. In case your development firm works on government-funded tasks, you’re legally required to supply weekly licensed payroll studies. This characteristic is crucial for guaranteeing compliance with laws just like the Davis-Bacon Act, which mandates that staff on public works tasks are paid prevailing wages.

Job costing and workforce administration

Gusto’s complete job and workforce costing capabilities allow you to interrupt down prices by challenge, activity, or worker precisely. This transparency in job costing is instrumental in making exact challenge bids and managing budgets successfully.

Gusto integrations

Regardless of its complete options, Gusto has restricted superior options for correct time monitoring, together with GPS monitoring and geofencing.

Fortunately, Gusto integrates with varied software program that may make up for these shortcomings. These embrace accounting software program like QuickBooks and Xero, time and attendance methods like QuickBooks Time and Connecteam, and HR platforms resembling BambooHR. It additionally integrates with different important enterprise instruments, together with Slack and Google Workspace.

What customers say about Gusto

Top-of-the-line options is that we don’t have to fret about calculating and paying our payroll taxes…you plugin within the time playing cards and hit submit and it’s performed.

There needs to be a technique to have a wage that doesn’t change when the hours are modified. The opposite draw back is that if there may be an error, it’s a must to void all the payroll.

Key Options

- Automated tax processing and filings

- Time monitoring integrations

- Employees’ compensation administration

- Licensed payroll studies

Professionals

- Simplified multi-state payroll processing

- Enhanced compliance

Cons

- Lacks superior workforce administration options

- Interface will be overwhelming for first-time customers

Pricing

Begins at $40/month + $6/individual/month

Trial: No

Free Plan: No -

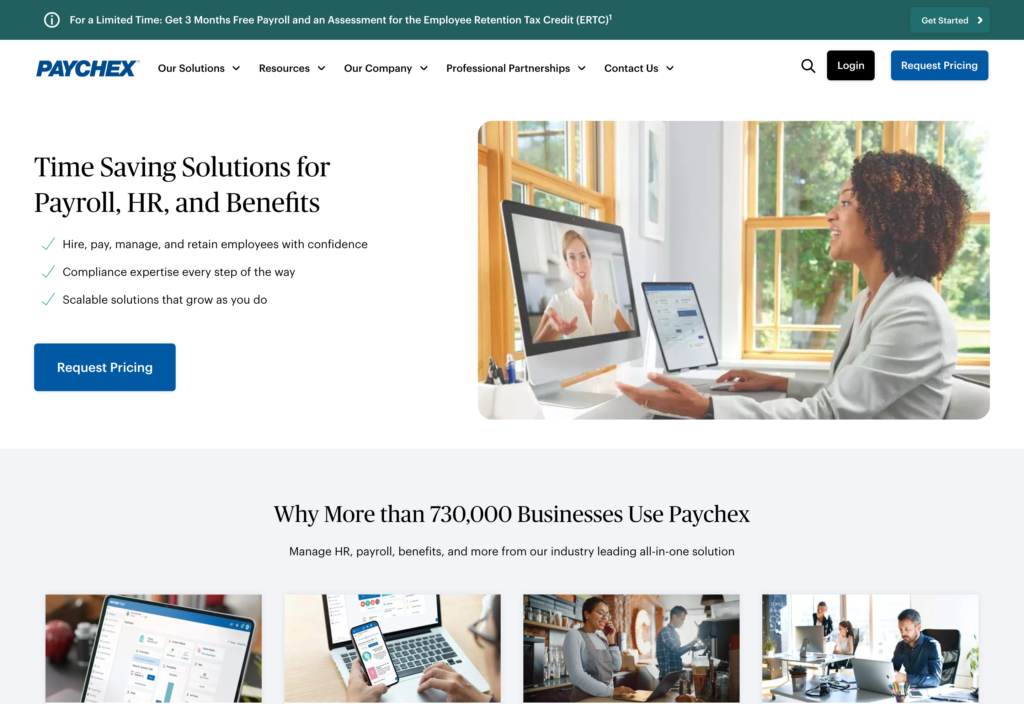

Paychex Flex — Good for tax submitting and tax credit

Accessible on

- Internet

- iOS

- Android

- Home windows

- Mac

Paychex Flex is a cloud-based payroll and human assets administration resolution designed to streamline and simplify enterprise processes for small to medium-sized companies.

Why I selected Paychex Flex: With options like tax compliance, time monitoring, advantages administration, and staff’ compensation, Paychex Flex is without doubt one of the finest payroll software program for small development firms.

Tax administration and credit

The software program’s strong tax submitting capabilities appealed to me. It ensures correct calculation, withholding, and submission of federal, state, and native payroll taxes, considerably decreasing the executive burden on companies.

Moreover, Paychex Flex provides specialised help for navigating tax credit, such because the Work Alternative Tax Credit score (WOTC) and the Worker Retention Tax Credit score (ERTC). Should you’re hiring to your development firm, WOTC may also help you save on taxes while you rent people dealing with employment challenges who’d match nicely into your development roles. And, for those who’ve stored your group on the payroll by means of robust instances—just like the COVID-19 pandemic—the ERTC provides you tax reduction to offset payroll prices.

Timekeeping and attendance administration

Paychex Flex’s time and attendance system integrates seamlessly with payroll course ofing. This method permits staff to clock out and in by means of a number of channels, together with cell units and net functions.

Sadly, superior time and attendance administration options like geofencing can be found solely with greater pricing, which might get costly.

Advantages and staff’ compensation administration

Paychex Flex additionally provides advantages administration, resembling medical health insurance, retirement plans, and extra. Plus, it features a complete method to managing staff’ compensation insurance coverage. The platform simplifies acquiring, managing, and adjusting insurance policies, which is essential for safeguarding companies and their staff towards the monetary impacts of office accidents.

Paychex Flex provides many different options, together with compliance instruments and detailed reporting capabilities that permit companies to research labor prices by challenge, activity, or worker.

Paychex Flex integrations

Paychex flex integrates with accounting software program like QuickBooks and Xero, time and attendance methods like Connecteam, HR platforms like BambooHR and Gusto, and different important enterprise instruments resembling Salesforce for CRM and Slack for group communication.

What customers say about Paychex Flex

Paychex is nice in serving to run studies for my licensed payroll tasks.

When making an attempt to sync with our accounting software program it could take anyplace from per week to a month to get the difficulty resolved.

Key Options

- Superior tax submitting and credit (WOTC, ERTC)

- Time monitoring

- Advantages administration

- Employees’ compensation administration

Professionals

- Integration with accounting and enterprise methods

- Enhanced compliance

Cons

- Pricey add-ons

- Complicated interface

Pricing

Contact vendor for worth

Trial: No

Free Plan: No -

QuickBooks Payroll — Good for accounting and bookkeeping

Accessible on

-

Internet

- iOS

- Android

- Home windows

- Mac

QuickBooks Payroll is a complete payroll resolution developed by Intuit.

Why I selected QuickBooks Payroll: It’s designed to combine with QuickBooks accounting software program, making it an excellent selection for small to medium-sized development firms.

Automated payroll course ofing and labor costing

QuickBooks Payroll provides automated tax calculations and filings, direct deposit, and the power to run payroll on any system, enhancing flexibility for companies with staff throughout a number of job websites.

It additionally helps managing subcontractor funds and gives detailed labor costing, enabling you to trace bills towards particular tasks or duties precisely. I discover this very useful.

Built-in time monitoring and compliance

Sadly, QuickBooks provides solely fundamental time-tracking and worker administration options. You’ll be able to’t handle worker availability or use biometric verification for clock-ins, for instance.

Nevertheless, you possibly can combine QuickBooks Payroll with QuickBooks Time or third-party options like Connecteam to achieve strong time monitoring capabilities.

Plus, QuickBooks Payroll facilitates compliance with development {industry} requirements, together with producing licensed payroll studies required for presidency contracts.

QuickBooks Payroll integrations

QuickBooks Payroll integrates seamlessly with varied important enterprise instruments, together with accounting platforms like QuickBooks On-line, time monitoring and workforce administration options like Connecteam, and challenge administration apps resembling Asana and Trello.

What customers say about QuickBooks Payroll

When you discover ways to use it and customized your studies, it saves time and the info from years again will be accessed.

Customer support transfers you round many instances as a result of nobody owns the problems with payroll with contractors.

Key Options

- Automated tax calculations and filings

- Direct deposit

- Integration with QuickBooks accounting

- Subcontractor funds administration

Professionals

- Simplified tax compliance

- Multi-channel help

Cons

- Complexity will increase with added options

- Restricted customization

Pricing

Begins at $75/month + $6/person/month

Trial: Sure — 30-day

Free Plan: No -

-

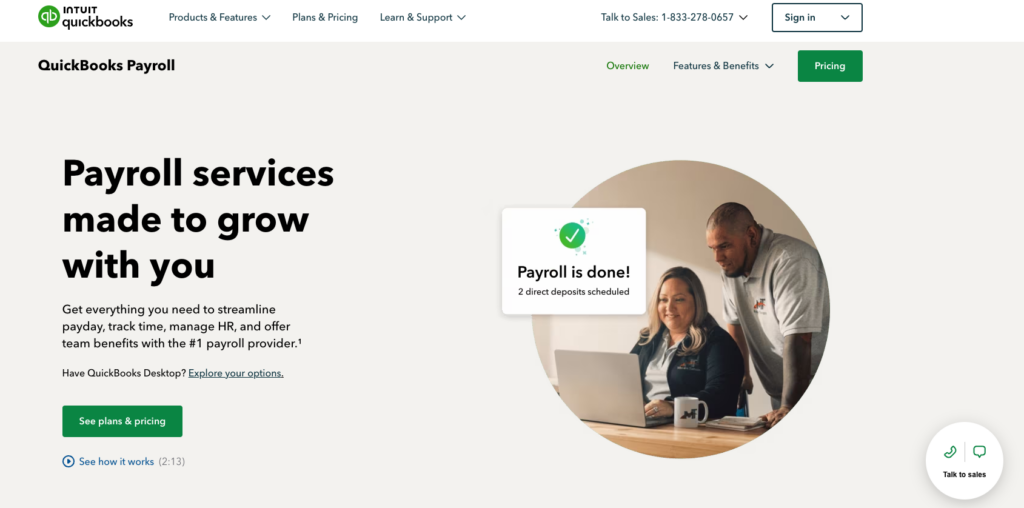

RUN by ADP — Good for world payroll

ADP Run is a dynamic payroll and HR resolution engineered by ADP, famend for its outsourcing providers and payroll resolutions tailor-made for small to medium-sized companies.

Why I selected ADP Run: ADP Run provides varied instruments to streamline development payroll, together with world payroll.

Versatile payroll administration and reporting

ADP Run effectively manages numerous employment sorts, together with full-time, part-time, and subcontractor roles. It additionally provides detailed reporting for correct labor value allocation, bettering funds management and monetary oversight.

Sadly, time monitoring and advantages administration options value additional.

World payroll capabilities and worker portal

In case your development enterprise operates in several nations, ADP Run provides strong world payroll capabilities. It handles payroll throughout North America, Europe, Asia, and the Center East, enabling you to pay staff of their native foreign money and streamline worldwide payroll administration.

Moreover, it helps licensed payroll studies for presidency contracts and gives staff safe on-line entry to paystubs, W-2s, and important data.

ADP Run integrations

The platform integrates with lots of of third-party instruments, together with HR methods like Zoho Individuals and Workday, accounting software program like QuickBooks and Xero, and time and attendance options like PayClock and Time Physician. It additionally integrates with advantages administration instruments like Particularly and Zenefits.

What customers say about Run ADP

Straightforward navigation, nice options, straightforward to do one time adjustments, customized messages. Nice studies on a single payroll, quarter or customized date ranges.

Not fairly as suitable as I believed it might be with Time&Attendance.

Key Options

- Payroll administration

- Licensed payroll reporting

- Tax submitting and reporting

- Labor costing

Professionals

- Detailed reporting capabilities

- Compliance with industry-specific laws

Cons

- It may be costly for small companies

- Interface could also be advanced for brand new customers

Pricing

Contact vendor for worth

Trial: Sure

Free Plan: No -

Rippling — Good for intensive integrations

Accessible on

- Internet

- iOS

- Android

- Home windows

- Mac

Rippling is a cloud-based platform that streamlines HR and IT operations, providing built-in options for payroll, advantages, worker administration, and extra.

Why I selected Rippling: This development firm payroll software program provides a holistic suite of providers, together with payroll, advantages administration, and HR administration.

Employee administration and world payroll help

Rippling excels in managing each W-2 staff and 1099 contractors inside a unified system, streamlining the onboarding, fee, and administration processes for development companies. Its world payroll help can be notable, enabling firms to effectively handle worldwide staff with compliant tax calculations and filings throughout a number of nations.

Monetary administration and compliance

Rippling additionally provides detailed labor value monitoring and reporting, enabling exact funds administration and challenge monetary evaluation. Moreover, the platform helps companies adhere to laws with its compliance instruments.

Rippling integrations

I seen that Rippling provides very fundamental time monitoring and advantages administration capabilities and lacks superior options, which is a disadvantage.

Fortuitously, Rippling provides 500+ integrations, together with time monitoring apps like Clockify, accounting methods like QuickBooks and Xero, and advantages administration instruments like Zenefits and ADP.

What customers say about Rippling

From Onboarding and Advantages elections and enrollments to payroll and timekeeping – Rippling is the powerhouse that retains us going!

The preliminary setup and onboarding was a bit time consuming. Would have paid extra money to have somebody information us by means of and assist arrange our account with us.

Key Options

- Built-in administration for W-2 staff and 1099 contractors

- Labor value monitoring and reporting

- Compliance instruments

- Licensed payroll reporting

Professionals

- Intensive integrations with third-party functions (500+)

- Scalable

Cons

- Could have a steeper studying curve for brand new customers

- Is pricey for small companies

Pricing

Begins at $8/person/month

Trial: Sure

Free Plan: No

What Is Development Payroll Software program?

Development payroll software program is specialised software program designed to handle and course of payroll for companies inside the development {industry}. It addresses the distinctive payroll wants and challenges confronted by development firms.

These challenges embrace dealing with a number of job websites, complying with varied tax legal guidelines and laws particular to development work, and managing a various workforce that features full-time, part-time, contract, and unionized staff.

How Does Development Firm Payroll Software program Work?

Development payroll software program automates and streamlines payroll course ofes within the development {industry}. It reduces guide errors by integrating payroll calculations with time monitoring.

The software program provides managers a sturdy platform for overseeing payroll operations, from worker time approval to compliance reporting. It facilitates real-time monitoring of labor prices and streamlines administrative duties related to time monitoring and paying staff.

Workers use the software program to clock out and in, monitor work hours, and entry pay charges data. Managers use the system to evaluation and approve timesheets with ease earlier than utilizing them to course of payroll.

This method fosters a extra environment friendly office by enabling managers and staff to deal with their core duties with the boldness that payroll and compliance are dealt with successfully.

The Advantages of Development Payroll Software program

The perfect payroll software program for development firms gives the next advantages.

Streamlined operations

Development payroll software program automates payroll course ofes, decreasing guide errors and guaranteeing well timed worker funds. This effectivity frees administration to deal with core challenge actions, enhancing general operational productiveness.

Compliance assurance

Development payroll software program stays present on authorized necessities. It mitigates dangers by mechanically updating tax deductions and guaranteeing correct pay primarily based on regulatory necessities, together with union necessities for unionized development staff and licensed payroll necessities for presidency tasks.

Value management

The software program provides real-time labor value monitoring and job costing insights, aiding in exact funds administration and profitability. Correct monetary forecasting and management over challenge bills result in higher decision-making and aggressive pricing methods.

Transparency and belief

Offering staff entry to paystubs and tax data promotes transparency, builds belief, and reduces conflicts. This stage of openness is key to bettering worker relations and retention within the aggressive development {industry}.

How A lot Does Development Payroll Software program Value?

Development payroll software program pricing varies primarily based on options, operation scale, and person numbers. Most software program provides a month-to-month subscription, which is usually tiered primarily based on the variety of customers and desired options. Anticipate ranges like $30-$75/person/month for established software program like ADP and Paychex. Specialised options like Rippling usually fall inside the $50-$100/person/month vary.

Connecteam stands out with its Small Enterprise Plan, totally free for as much as 10 customers. This makes it top-of-the-line payroll software program for small development firms in search of complete options with out upfront prices. For bigger groups, the paid plans stay competitively priced at simply $29/month for as much as 30 customers.

FAQs

What’s the finest payroll software program?

The perfect payroll software program is dependent upon your online business wants, however in style choices embrace Gusto, QuickBooks Payroll, ADP Run, and Paychex Flex, recognized for his or her complete options, ease of use, and scalability.

What’s HR payroll software program?

HR payroll software program helps companies handle their worker paychecks and tax types. It automates duties like calculating salaries, withholding taxes, and producing paychecks. It may additionally assist monitor time and attendance, handle advantages, and adjust to labor legal guidelines.

Is Excel a payroll software program?

No, Excel will not be a payroll software program. It’s a spreadsheet program used for varied information administration duties. These can embrace payroll calculations, however Excel lacks the automation, tax compliance, and integration options of devoted payroll software program.

The Backside Line On Development Payroll Software program

Managing payroll within the development sector requires precision and effectivity attributable to its distinctive calls for and regulatory necessities. With out the fitting instruments, precisely monitoring your staff’ hours, complying with legal guidelines, and paying your workforce will be difficult.

The market provides varied platforms designed to deal with these challenges. When choosing a payroll administration system, choosing an answer that simplifies the payroll course of and ensures precision and compliance is essential.

In my view, Connecteam is the finest all-in-one payroll software program for development firms. It provides a complete toolkit for exact timekeeping, automated digital timesheets, and seamless integration with payroll methods, all inside an intuitive and cost-effective platform.

[ad_2]