[ad_1]

7. Conduct Common Audits

When was the final time you audited your compensation technique and payroll course of? If it’s been greater than 12 months, add it to your to-do listing. Common audits of worker classifications, tax withholdings, and profit calculations assist finance groups determine and rectify errors promptly.

However along with auditing for accuracy, it’s important to research your present compensation technique. Run stories to identify any developments or alternatives for enchancment. Are particular demographics receiving extra promotions than others? Are new hires incomes greater than seasoned workers?

This payroll recommendation contributes to not solely the corporate’s monetary well being but in addition its organizational well being. Common auditing practices assist guarantee honest and equitable compensation throughout groups, foster worker belief, and promote transparency.

8. Equip Staff With a Self-Service Portal

We’re all responsible of sending the “the place does that data stay, once more?” e-mail. And it is sensible, as the common firm has 15-35 completely different instruments of their HR tech stack.

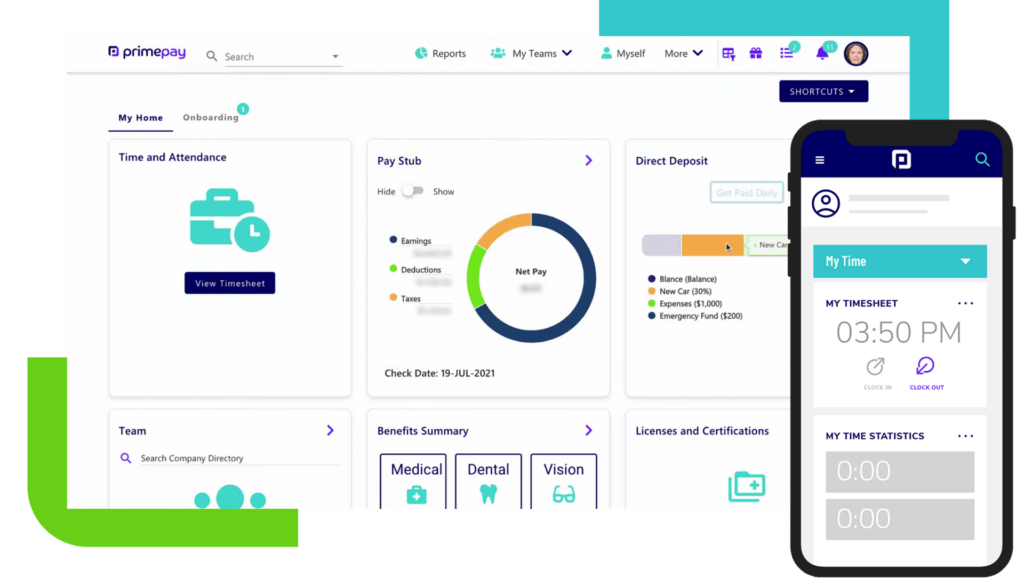

One resolution to the fixed back-and-forth is to equip your folks with an worker self-service portal. With one login, workers can entry pay stubs, tax paperwork, PTO, time sheets, and different private data.

With the proper software program, workers can entry firm sources, full tax kinds, enroll in direct deposit, and elect advantages, multi functional place.

9. Put together for 12 months-Finish Reporting

Plan for year-end reporting necessities, together with W-2 and 1099 kinds, to keep away from last-minute hassles and forestall potential points with tax authorities.

Moreover adhering to authorities necessities, there’s another excuse to arrange your year-end stories: sound decision-making. When you’ve a transparent and exact monetary image of the enterprise, you possibly can precisely plan for headcount, bonuses, and different monetary choices that align together with your strategic objectives.

10. Spend money on Dependable Payroll Software program

You might spend 5 hours a month managing payroll, checking state and federal updates, chasing down lacking data on time playing cards, and double-checking each knowledge entry. However the higher manner is to spend money on dependable payroll software program that handles payroll complexities so that you don’t should.

Payroll software program automates calculating and distributing worker salaries, taxes, and different compensation-related actions. It additionally ensures correct and well timed worker cost whereas managing deductions, advantages, and tax compliance. These advantages aren’t simply useful for finance groups; they’re additionally crucial for workers. As a result of 58% of individuals stay paycheck-to-paycheck, they will’t afford to attend on mounted payroll errors.

In case you’re available in the market, take into account payroll software program that features worker time administration and HR capabilities. Why? Having linked time will take away the necessity for guide timesheet entry, which is liable to errors, and HR software program centralizes all of your knowledge in a single place so you may make the very best choices for your online business and other people.

Handle Payroll Like a Professional

The above payroll suggestions aren’t simply steps – they’re a roadmap to rework payroll processes from establishment to exemplary. Embrace scalable options, empower workers with self-service portals, and keep proactive with common audits and employees coaching.

By doing so, you’re not simply managing payroll; you’re setting the stage for progress, fostering worker satisfaction, and guaranteeing your group thrives in the long term.

[ad_2]